Dive Brief:

- Consumer sentiment slumped in September for the second consecutive month, dragged down by worries about job security, price pressures and the outlook for U.S. business, the University of Michigan said Friday, describing survey results.

- “Consumers perceive risks to their pocketbooks,” Joanne Hsu, director of the university’s consumer surveys, said in a statement. “Trade policy remains highly salient to consumers, with about 60% of consumers providing unprompted comments about tariffs during interviews,” she said.

- Long-run inflation expectations rose to 3.9% from 3.5% last month, Hsu said, while noting that consumers expect 4.8% inflation in 12 months. Several economists have recently said that import taxes are beginning to play a bigger role in pushing up prices.

Dive Insight:

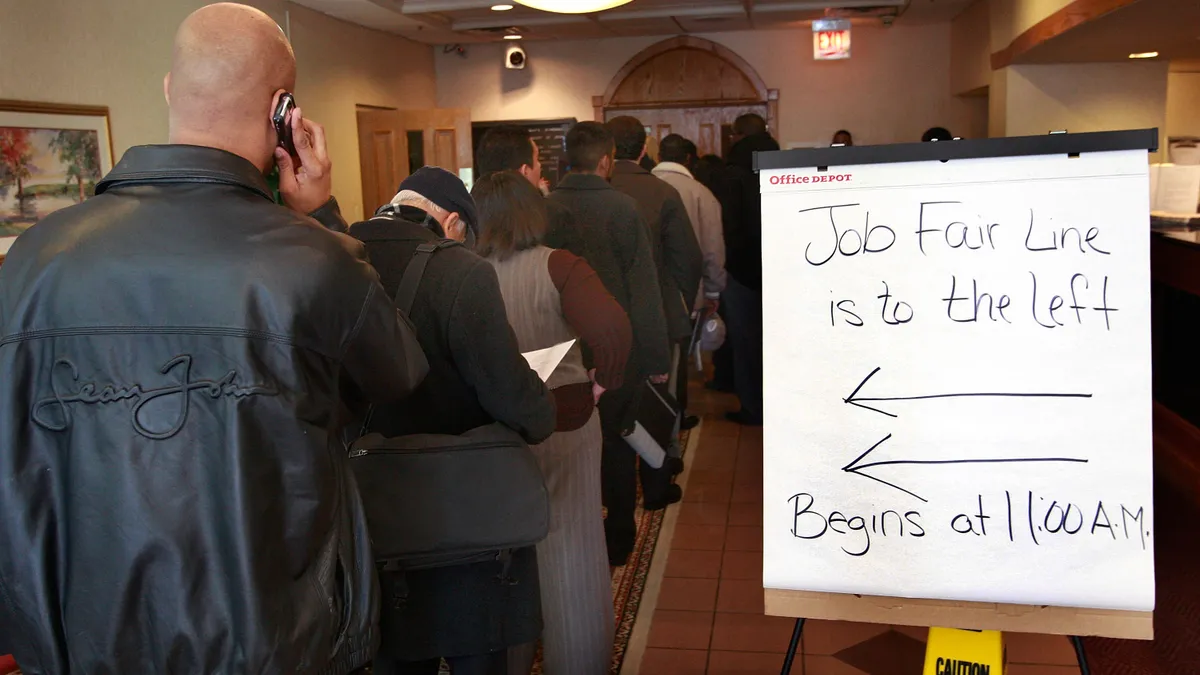

The university’s survey results echo those from the Conference Board and Federal Reserve Bank of New York highlighting that faster inflation and a cooling job market are undermining consumer confidence.

“Economic sentiment declined more than expected in September largely because Americans are fearful of losing their jobs,” Navy Federal Credit Union Chief Economist Heather Long said Friday. “After months of a frozen job market with little hiring outside of healthcare, people now see more industries turning to layoffs,” she said in an email.

“The American consumer is feeling the squeeze from tariffs,” Long said, noting that “they are starting to see price increases on everything from food to furniture to auto repair.”

Although consumers are still spending, “they are on edge and will be ready to shut their wallets if layoffs pick up this fall and winter,” she said.

The labor market in recent weeks has flashed several warning signs.

The Bureau of Labor Statistics on Tuesday announced a record revision of job growth during the 12 months through March. Payroll growth will probably be slashed by 911,000, or 0.6%, the BLS said in a preliminary report.

Also, overall U.S. hiring fell in August across the economy, and unemployment rose to 4.3%, the Labor Department said this month.

The mix of rising inflation and weaker employment complicates efforts by the Fed to meet its dual congressional mandate to ensure stable prices and maximum employment.

Policymakers will likely subordinate concern about persistent inflation to their concern about the dimming outlook for jobs. They are widely expected to trim the federal funds rate by a quarter percentage point at a two-day meeting ending Sept. 17.

Fed Chair Jerome Powell during a post-meeting press conference will probably “cement his pivot from focusing on upside risks to inflation to worrying about downside risks to the labor market,” economists with Bank of America Securities said Friday in a research note.

With the price shock from import taxes likely to last for at least a few more quarters, the central bank has ample reason to worry about inflation persisting well above its 2% long-run goal.

Inflation accelerated last month to the fastest pace this year.

The Consumer Price Index rose 0.4% in August — 2.9% on an annual basis — after a 0.2% monthly gain in July, the Bureau of Labor Statistics said Thursday.

A 0.3% gain last month in the cost of new vehicles, 1% increase for used cars and trucks, and 0.5% rise in the prices for both apparel and video and audio products underscored the inflationary impact from import duties.

Still, traders in interest rate futures believe the Fed will focus on averting widespread job losses. On Friday they saw a 79% probability that the central bank will trim the benchmark interest rate by at least 0.75 percentage point by December, according to the CME FedWatch Tool.