Call it the Costco effect. Late last month warehouse club retailer Costco Wholesale filed suit against the Trump administration seeking a declaration that tariffs imposed under the 1977 International Emergency Economic Powers Act are unlawful, and asking for a “full refund” of the duties it had already paid.

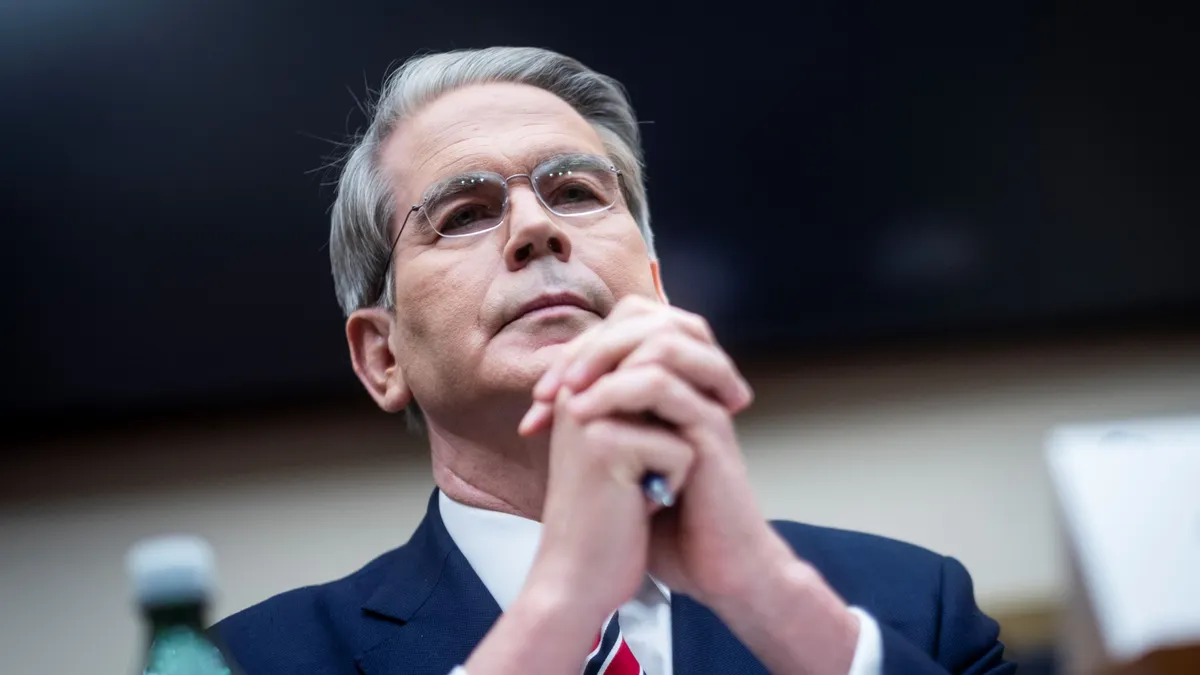

Since then Doreen M. Edelman, a partner and chair of global trade and national security at the Lowenstein Sandler law firm, has been getting several calls a day from companies anxious to know whether they too should file suit to obtain or at the very least preserve their rights to refunds of the duties they have paid.

“The Costco case made a lot of companies nervous,” Edelman said in an interview Monday, adding that firms were essentially wondering whether they should take similar legal action as they await a decision from the U.S. Supreme Court on the legality of the sweeping tariffs put in place this year by President Donald Trump.

Last month Supreme Court justices questioned both sides of the historic consolidated case, Learning Resources Inc et al v. Trump and V.O.S. Selections Inc. et al v. Trump, filed by plaintiffs representing a dozen states as well as small businesses that claim severe financial harm if what Trump calls “reciprocal tariffs” are upheld, CFO Dive sister publication Supply Chain Dive reported.

A decision in the case will likely provide more clarity, but for now Edelman says Costco-style litigation is only one of a number of strategies that companies can pursue to position themselves for refunds. In an interview with CFO Dive, Edelman dissected the state of play of the legal and procedural issues that may affect companies that want to protect their rights to recouping duty payments.

The following Q&A has been edited for clarity and brevity.

CFO Dive: What should companies and CFOs know about potential tariff refunds?

Doreen M. Edelman: Let’s step back. Let’s assume that the Supreme Court says these tariffs were illegal...Then the question is: so what does the court do about refunds? Normally they instruct the lower court. So if this goes back down to the Court of International Trade it has options as well, one of which is telling [U.S. Customs and Border Protection] who collects the duties to figure out a way to do it. Now they’ve been through this before where they’ve just unilaterally said we’re going to refund all duties, here’s the process. But in this case we certainly know the Trump administration is not going to be happy to give back all these billions of dollars.

CFO Dive: Why did Costco file its suit?

Doreen M. Edelman: They had made payments early in the process and they felt they were concerned that, let’s say the Supreme Court doesn’t rule until the spring, they may not have time to get all the documents in to meet the protest deadline. That’s one reason. The other reason is [Costco’s] got a lot of money coming back. It’s a lot of paperwork. They have a lot of entries...So it made perfect sense for Costco to file also because it’s not afraid of the government. It knows it has extremely loyal customers and it’s not going to lose and it’ll probably even gain reputation if it files, so everything lined up for Costco to make this filing.

CFO Dive: It was interesting how urgent Costco’s suit was.

Doreen M. Edelman: That’s what scared a lot of people. They were trying to extend the liquidation point. That’s a key point. They were rejected so they were put in a position that was more tenuous. Now, other companies have tried to extend their liquidation date and it’s happened.

CFO Dive: What advice do you have for companies wondering if they should file?

Doreen M. Edelman: The first thing I’m telling companies is, we need to know when your goods are going to liquidate. Call your broker or do your homework, tell me when your goods are going to liquidate and then we can talk about the options...Where do they want to spend their money, do they want to go ahead and spend more money and make a court filing?

In most cases it makes sense to wait a little bit. If you’re not going to liquidate until the beginning of next year there’s no rush. Let’s see what the Supreme Court says. Now, if we get some indication where the Supreme Court says we don’t know how to handle it, we’re going to send it to CIT and CIT says well we’ll review it but we’re not going to expedite it…then a company can decide, ‘is this too slow for us, will we be bankrupt by then…do we need another option?’ And one way may be to go ahead and file or join a suit.

CFO Dive: What is liquidation?

Doreen M. Edelman: It is nominally written as 314 days after you import. It’s kind of like a reconciliation of the final price.

CFO Dive: What are the existing procedures outside of litigation that companies use to get tariffs refunds?

Doreen M. Edelman: Within so many days of filing your entry you can do a post-summary correction and say, ‘I made a mistake, I paid this amount in duties but now those duties are illegal so I should have only paid this amount of duties.’ But that’s not a ripe process yet so put that option aside. Another option is to say let’s ask CBP to extend our payment due date...the liquidation date, and if we can get that extended, once we hear from the Supreme Court we then could adjust our paperwork to get refunds using this protest system, which is the third option if you haven’t yet liquidated or finalized your duties on all these entries.

For a lot of my clients...we haven’t hit that 300 day typical liquidation day yet, so there’s plenty of time because once they liquidate you then have 180 days to file a protest which is the traditional way to ask for your money back.

CFO Dive: What are you expecting with regard to the timing of a Supreme Court ruling on this?

Doreen M. Edelman: Some people said [it would come in] December. I’m hesitant on that because it’s a big decision and every member of the court may want to weigh in on it and they have to decide who is going to write the opinion. And you’ve got the holidays. I think it will come out in the spring.