Dive Brief:

- U.S. merger-and-acquisition activity saw little growth in the first half of the year despite high hopes at the start of President Donald Trump’s second term in office, according to a recent PricewaterhouseCoopers report.

- An upswing is still possible going forward, but it’s unlikely without more policy clarity and stability, the report said.

- “Policy and economic uncertainty have put a damper on overall deal volume,” PwC U.S. Deals Platform Leader Kevin Desai said in an interview.

Dive Insight:

The total number of U.S. M&A transactions in January through the end of May was 4,535, comparable to the year-earlier period, which saw 4,515 deals, according to PwC.

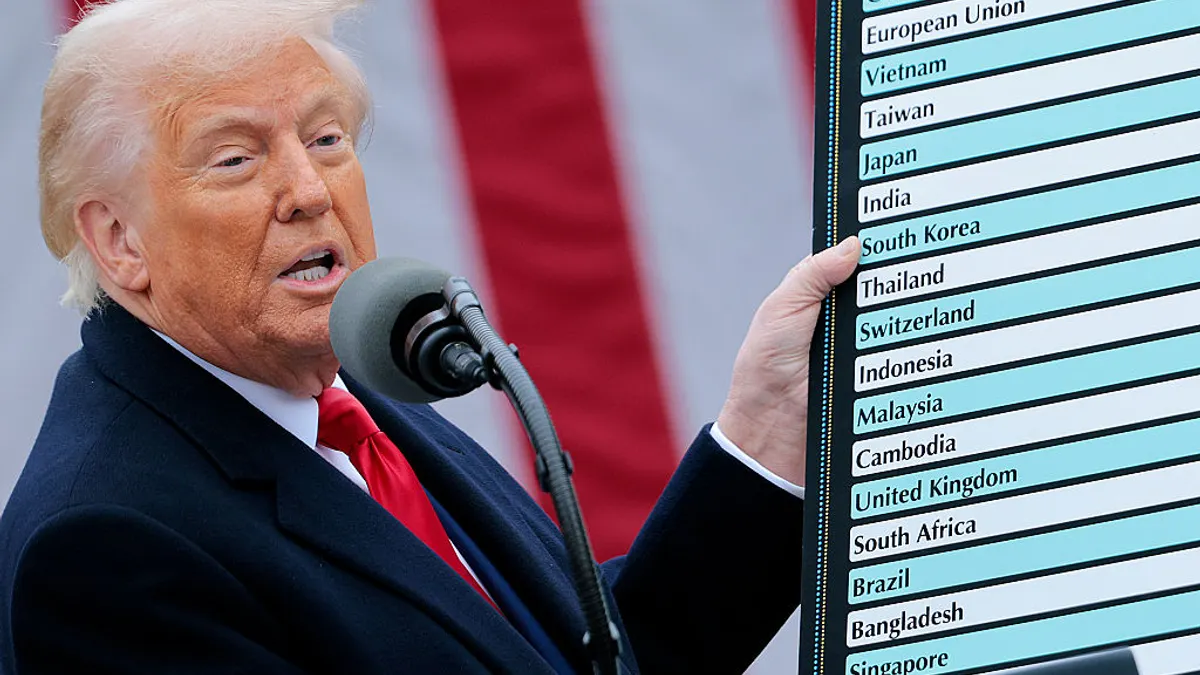

Before Trump took office in January, there were expectations for an M&A revival this year, but his administration’s aggressive policies — particularly in the area of trade — have dampened enthusiasm for new deals, at least temporarily, the Big Four accounting firm said.

In a May “Pulse Survey,” PwC found that 30% of organizations have paused or are revisiting deals due to tariff issues.

“Dealmaking growth stalled as companies struggled to predict how new tariff policies would impact business models — or if the policies would change before implementation,” the report said.

The current environment will create opportunities for strategic buyers who can “move quickly and decisively,” PwC said, cautioning that scenario planning around sources of uncertainty needs to be conducted more frequently, such as once a month instead of once a quarter or annually.

CFOs in particular will need to carefully manage liquidity and the financial fundamentals of their business, according to the report.

“Position balance sheets so your company can move quickly when market conditions become more favorable — or when advantageous buy or sell opportunities arise,” it said.