Dive Brief:

- Semiconductor manufacturer Wolfspeed announced industry alum Gregor van Issum will take the role of CFO effective Sept. 1, following “a comprehensive review of internal and external candidates,” according to a Monday press release. He will succeed interim CFO Kevin Speirits, who will remain with the company to ensure a smooth transition.

- The CFO appointment comes shortly after the Durham, North Carolina-based company filed for Chapter 11 bankruptcy on June 30 as part of a restructuring plan aimed at reducing its debt and strengthening its capital structure, according to a press release at the time. The company is aiming to offload 70% of its debt or approximately $4.6 billion with the restructuring.

- “In this new role, my priority will be providing Wolfspeed’s investors with transparency and clarity, especially during this transformative period,” Van Issum said in a statement included in the release.“Building on recent steps to restructure Wolfspeed’s balance sheet, I will draw on my experience navigating complex business cycles to help create a capital structure that offers agility to respond to rapid shifts in the market.”

Dive Insight:

A 20-year alum of the technology industry, Van Issum most recently served as EVP and group controller for fellow semiconductor manufacturer ams-OSRAM, according to the Monday press release.

Prior to ams-OSRAM, he spent 11 years in various strategic finance and executive roles at NXP Semiconductors, including a VP, head of strategy BL secure transactions and identification — a role responsible for the strategic marketing of global security transactions and identification business, according to his LinkedIn profile.

As CFO, Van Issum will receive an annual base salary of $500,000, according to a securities filing. He will also be eligible for an annual performance bonus with a target value of 75% of his base salary and will receive a cash sign-on bonus of $450,000, according to the filing with the Securities and Exchange Commission. Additionally, Van Issum will receive an award of restricted stock units with a value of $3 million, with one-fourth of the RSUs to vest on each of the four anniversaries following his Sept. 1 effective date, per the filing.

Van Issum’s appointment is the latest executive leadership move by the semiconductor manufacturer as it looks to revitilize its balance sheet, coming after the firm tapped a company veteran for the newly-created role of chief operating officer and appointed Robert Feurle to its top executive seat and as chairman of the board this May.

The reconstituted leadership team will aim to shepherd the company through its planned restructuring. Wolfspeed and its subsidiary Wolfspeed Texas LLC each filed Chapter 11 bankruptcy petitions in the U.S. Bankruptcy Court for the Southern District of Texas on June 30 after announcing a restructuring agreement with key debtholders on June 22, according to an SEC filing.

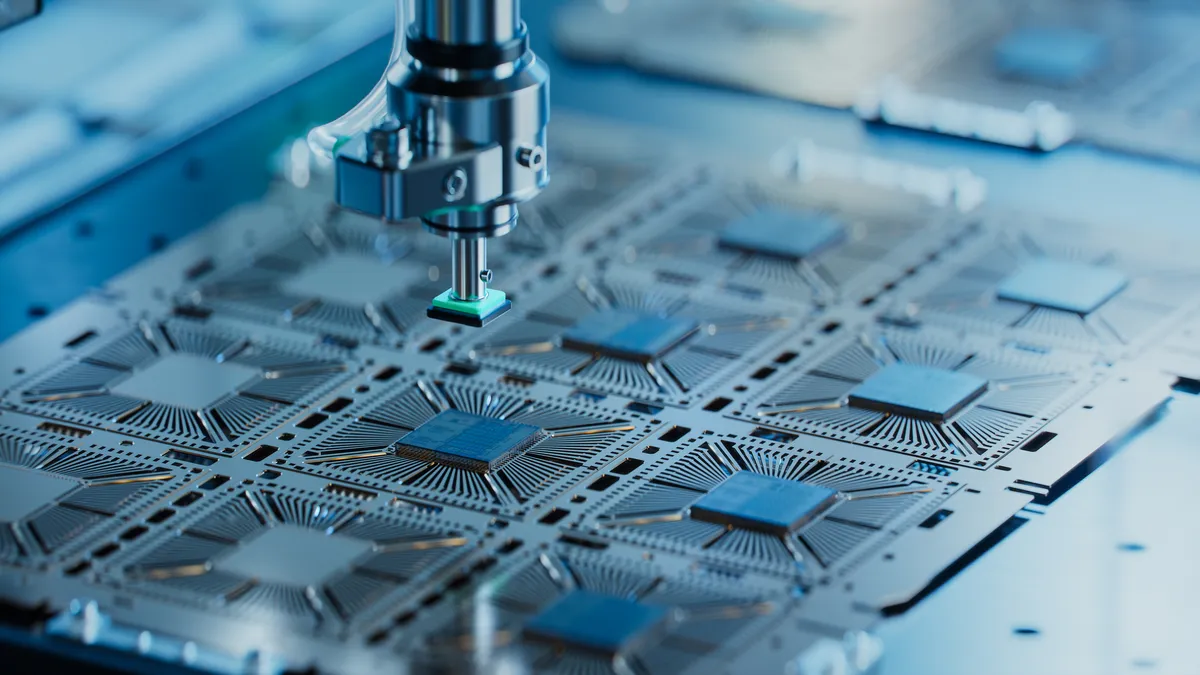

The bankruptcy is part of a bid by the chipmaker, which creates silicon carbide wafters and other chip components, to offload a significant portion of its debt and follows months-long talks with its lenders, The Wall Street Journal previously reported.

While Wolfspeed’s operations are mainly in the U.S. — putting it in an advantageous position given the tariffs proposed by the Trump administration — the semiconductor manufacturer’s debt has put a strain on its operations, the WSJ reported. As of its Chapter 11 filing, the company had approximately $6.7 billion in total funded debt, according to its disclosure statement.

The chipmaker has made previous efforts to cut down on costs and strengthen its balance sheet, laying off 20% of its global workforce and closing down several facilities as part of a strategy to save approximately $200 million last year, CFO Dive sister publication Manufacturing Dive previously reported.

In March, Wolfspeed announced plans to cut another 180 jobs, as part of an effort to boost its financial performance and “accelerate its path to generate positive free cash flow,” according to an SEC filing. The move came as a previously announced $750 million grant by the Biden administration under the CHIPS Act fell under a spotlight — later that same month, Wolfspeed’s stock fell to a 27-year low amid concerns that it would not receive the funding under the Trump administration. In May, then-Chairman Thomas Werner said the company was in the midst of a “constructive dialogue” with the Trump administration, Manufacturing Dive reported.

Wolfspeed did not immediately respond to requests for comment.