Change is a constant — and with the continued evolution of artificial intelligence, a shifting regulatory and economic environment, and new ways of working, it’s a more frequent constant than ever. These were some of the questions top finance chiefs — including FedEx CFO John Dietrich and Hasbro CFO and COO Gina Goetter — grappled with during a conference last week.

Today’s CFOs know they must be prepared for change, but as black swan events proliferate, that means being prepared for “everything and anything,” Dietrich said during a panel at the MIT Sloan School of Management’s 2025 CFO Summit.

While finance chiefs today are the ones tasked with ensuring their companies can juggle a number of different risks while still steering toward growth, established organizations tend to be “remarkably inertial beasts,” Nelson Repenning, a distinguished professor of organization studies at the MIT Sloan School of Management said during an opening keynote Thursday.

To effectively shepherd their organizations through present and future changes, CFOs need to start thinking differently about everything from how they are training and interacting with their teams, using AI, and managing risk. During the conference in suburban Boston, CFOs, finance and other business leaders discussed how these and other changes are impacting their roles now and how they could change the CFO role in the future, as well as what finance chiefs can do to be best prepared for such shifts.

Here are some of the top takeaways from the event.

All eyes are on AI — but not all hands

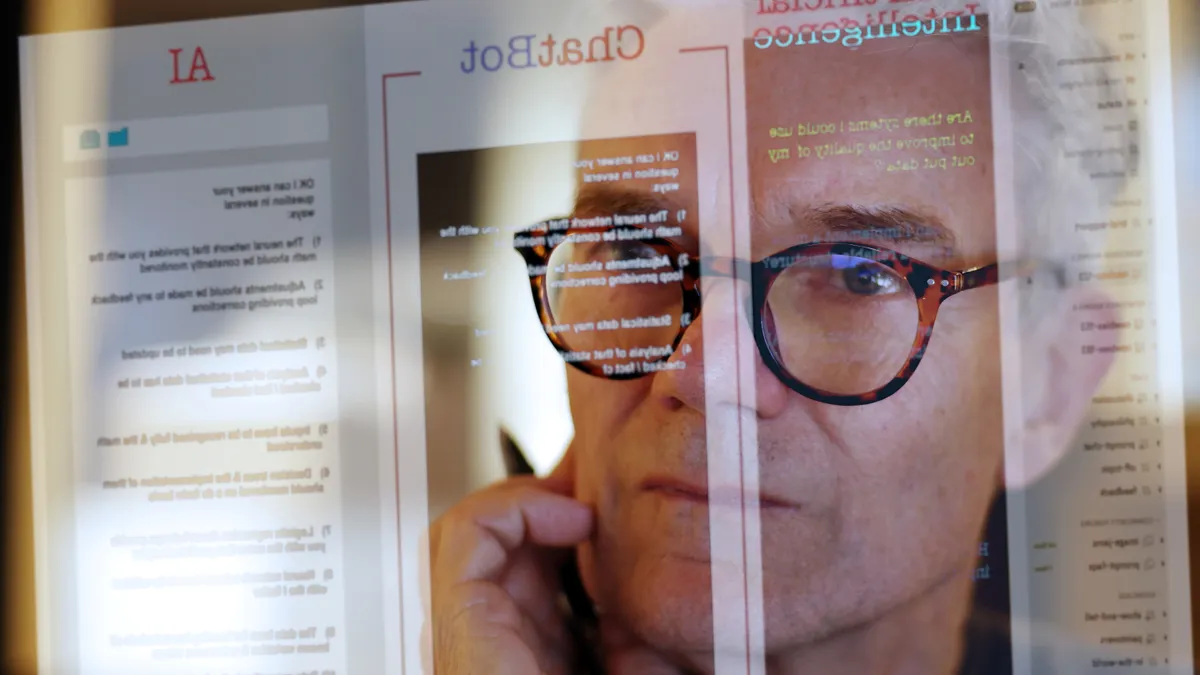

AI retained its crown as the main topic on everyone’s minds — but though finance chiefs are still experimenting with and investing in the technology, the right use cases and applications of the technology, especially in areas like finance, still remain murky.

As CFOs are inundated with a dizzying array of new AI tools promising to enhance their companies’ workflows, they need to ensure they have answers to critical questions — including actually defining what counts as AI, Jason Child, executive vice president and CFO for semiconductor business Arm Holdings said during a keynote fireside chat last week. Many of the tools present are “currently more automation than AI,” Child said, making it essential that CFOs peer beyond the hype.

In examining new AI tools that could be integrated into the business, CFOs need to ensure they understand the full capabilities of those solutions — and where they mesh, and more importantly don’t fit, with those of finance.

For instance, finance is “deterministic,” while large language models are “probabilistic,” he said, meaning an LLM will provide the highest probability of a right number — while not necessarily providing the right number. As such, CFOs need to understand “where I can trust [the LLM] and where I can’t,” he said. Another critical question finance chiefs need to ask is, “how clean is your data?” Child said.

Social, storytelling skills rise in priority

AI on its own has tremendous promise: but AI plus humans with strong analytical, interpretative or creative skills is a combination with even more potential, CFOs said repeatedly during the summit. Though AI could potentially remove a large amount of manual, time-consuming tasks from employees’ dockets, it’s crucial for leadership to continue to entice and retain top talent even in the AI age.

The dawn of AI has drawn some of the process issues that have longed faced businesses into higher relief, MIT professor Repenning said during a keynote speech. While large, established organizations may have plans to utilize new tools to free up time and money, they tend to stumble on the change management aspect — in part because they have an opaque view of their teams’ workflows.

“What happens when we take essentially static processes and we use them to try and manage a fundamentally dynamic world?” Repenning asked. In the face of rapid change, the assumptions and predictions made by companies quickly fall out of line with current events and challenges, “and then what happens is, all of the people who work for you, because they are smart, they are talented, they are well-intentioned, what they do is, they work around those processes,” he said.

As such, strong social networking and narrative skills are becoming more critical and highly-sought after among employees: CFOs themselves highlighted the critical role such skills played in their own careers. During a discussion on the rising number of pathways one can take to the top finance seat nowadays, panelists pointed to adaptability, a willingness to try out new things and a focus on sharpening their narrative or storytelling skills as factors that led them to their own CFO chairs.

One of the biggest learning curves of Jama Software CFO Marc Litz’s career was learning to tailor the financial story to the audience you’re talking to, he said during the panel. In communicating quarterly results, for instance, CFOs are speaking to several different groups, including their own internal teams, the board, and external investors, “and so the biggest nuance in communicating those results, it’s the same story but the level of detail you go into is markedly different,” he said.

CFOs continue to absorb operations

As businesses look to navigate an expanding fleet of risks — including ongoing economic headwinds as well as regulatory shifts — the CFO is emerging as the leader often tasked with steering the ship. Dual roles, such as CFO and chief operating officer or CFO and president combinations, are swiftly becoming more common as the finance chief absorbs a higher level of responsibility for overall business strategy.

Hasbro CFO and COO Gina Goetter doesn’t see her role at the toy giant as being two distinct positions, she said during a panel — rather, it’s a blended role that straddles the line neatly between two complementary areas.

“There’s really no decision operationally that doesn’t wind up in a financial statement somewhere,” Goetter, who joined Hasbro as its CFO and COO from Harley Davidson, said during a panel.

Scott Roe, a fellow CFO and COO who serves in those seats for Coach and Kate Spade owner Tapestry, noted the combination of roles also depends on the personalities and company cultures involved. Roe, for instance, logged experience with supply chain and technology, and so it was a natural progression to take on operational responsibilities when the prior COO left, he said.

However, to effectively fulfill both those operational and finance responsibilities, Roe stressed the importance of skilled talent: “you have to have strong people, and you have to learn to delegate,” he said.

“One of the hardest things that I had to learn as I became a C-suite executive…was, ‘you know the answer, don’t give it,’” he said during the panel, quoting one of his mentors. “You’ve got to develop people, and let them run.”

Once more into the black swan breach

Finance chiefs are used to scenario planning for the best and worst of circumstances, especially as the rate of so-called “black swan” events has continued to increase over the past few years. The growing frequency of such events puts a premium on swift and accurate forecasting, but it has also left some CFOs to expect the unexpected — and to plan accordingly.

Black swan events are becoming so common, in fact, that it’s difficult to differentiate them from the challenges that are popping up every day, finance chiefs said during the summit.

“What is a black swan event, at this point?” Goetter said in the panel together with Tapestry’s Roe and FedEx CFO and EVP John Dietrich. Goetter’s first CFO role, when she took the top finance seat for Harley Davidson in 2020, was during the height of the COVID-19 pandemic, an experience which taught her that “you have to have lots of scenarios, you have to be super agile, and you can’t get paralyzed by analysis paralysis.”

The rising frequency of black swan events has also put a spotlight on supply chain, FedEx’s Dietrich said during the panel: “supply chain is a term that you never heard in the board room ten years ago, and now it’s paramount,” FedEx CFO said.

A former lawyer whose past experiences include serving as a litigation attorney for United Airlines, Dietrich pointed back to events previously highlighted in “force majeure” clauses in past contracts he had drafted — and noting “pretty much everything” outlined in such clauses has occurred over the past two decades.

“My point is, we should expect everything and anything is going to happen and plan for it,” he said.