Dive Brief:

- Over half (57%) of some 300 U.S.-based CFOs and other senior executives reported tariffs are already squeezing gross margins, with about a quarter of respondents seeing margin declines above the 6%-10% range, according to the findings of a survey by Big Four accounting firm KPMG conducted in May and June.

- At the same time, about one-third of the executives said they’ve already experienced a 16%-25% drop in foreign sales overall due to retaliatory tariffs. Especially broad-based impacts on sales were felt in China, where about 83% of companies reported seeing lower sales after the barrage of tariffs that were put in place by President Donald Trump on April 2.

- While many companies are already passing through some tariff costs to customers, additional price increases are expected in the next six months as companies revisit more contracts, Joe Lackner, a KPMG advisory partner in industrial manufacturing, told CFO Dive. “Those things take a while to work out,” Lackner said. “The next supply agreement that the [original equipment manufacturer] has with its supply base is going to deal with tariff pass-throughs a little bit differently because now they’re a substantial burden,” Lackner said in an interview.

Dive Insight:

While market volatility has eased as Trump’s flip-flops on tariff decisions have given way to some investors betting on the so-called “Trump Always Chickens Out” or TACO stance, assuming that he will retreat from dramatic levies, Trump this weekend took the market highs as an opportunity to move ahead again with aggressive tariffs, Fortune reported.

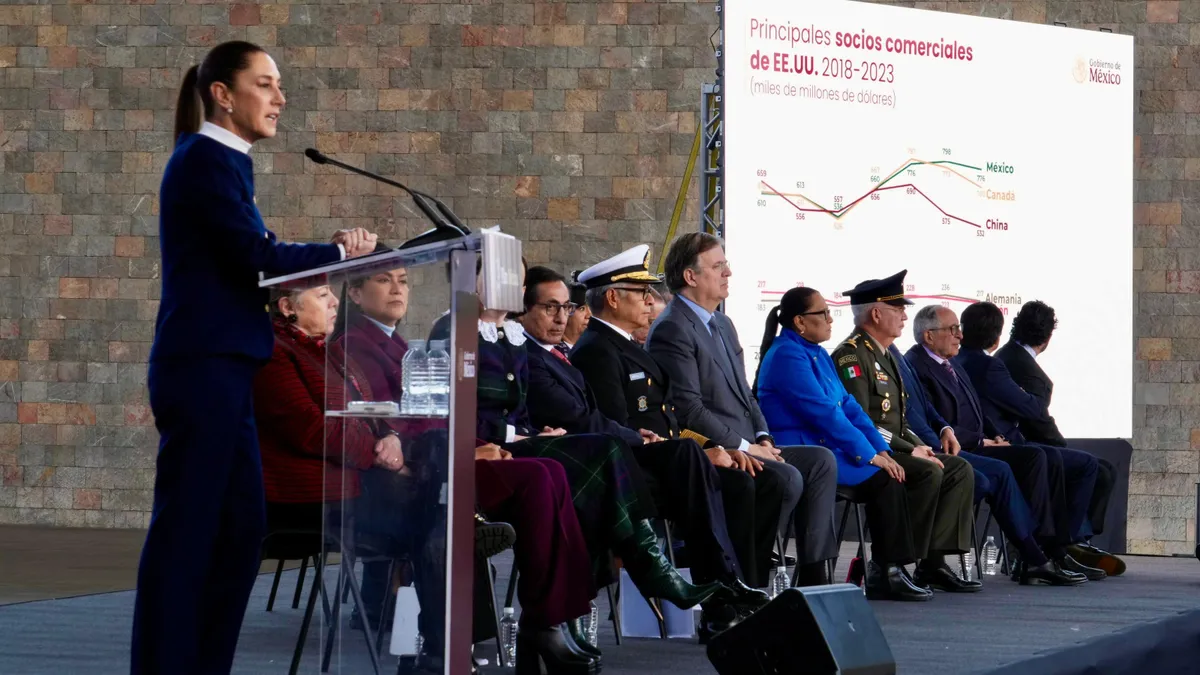

On Saturday morning, Trump announced that the U.S. will implement 30% tariffs on imports from the European Union and Mexico, effective Aug. 1. Since early March, imports from Mexico and Canada had only been subject to a 25% tariff unless they qualified for U.S.-Mexico Canada Agreement treatment, but it was not made clear on whether the USMCA exemption would continue under the new tariff rate, CFO Dive sister publication Supply Chain Dive previously reported.

Lackner said the fresh tariff change over the weekend shows that the stability companies are looking for in order to make capital investment decisions is still a ways out. While reporting that it can take seven to 12 months to set big supply chain adjustments into place, many companies have delayed capital investments needed to make those changes by up to a year in order to allow themselves time and breathing room to assess the uncertain trade environment, the report states.

The question that remains outstanding is how long companies can “keep their powder dry” and put those capital investment plans on hold while waiting for the tariff landscape to settle down. “How long can you delay without [it] being detrimental to your business?” Lackner asked.

One silver lining for jobs in the survey findings is that only 14% of the companies said they planned to reduce headcount even as they aim to use automation and AI to manage costs and tariff-related challenges.

Even as businesses are navigating a trade environment marked by “sustained disruption,” companies are “investing in automation, rethinking supply chains, and prioritizing technology to protect margins and jobs — while preparing for longer-term shifts in cost structures, sourcing strategies, and global demand dynamics,” Lackner said in a statement shared with CFO Dive.