Dive Brief:

- GlobalFoundries CFO John Hollister has stepped down from his position effective immediately for personal reasons, the chipmaker said in a Monday press release.

- The Malta, New York-based semiconductor manufacturer named Sam Franklin, its senior vice president of business finance, operations and investor relations, to serve as interim finance chief while it conducts a search for a permanent CFO, according to the release.

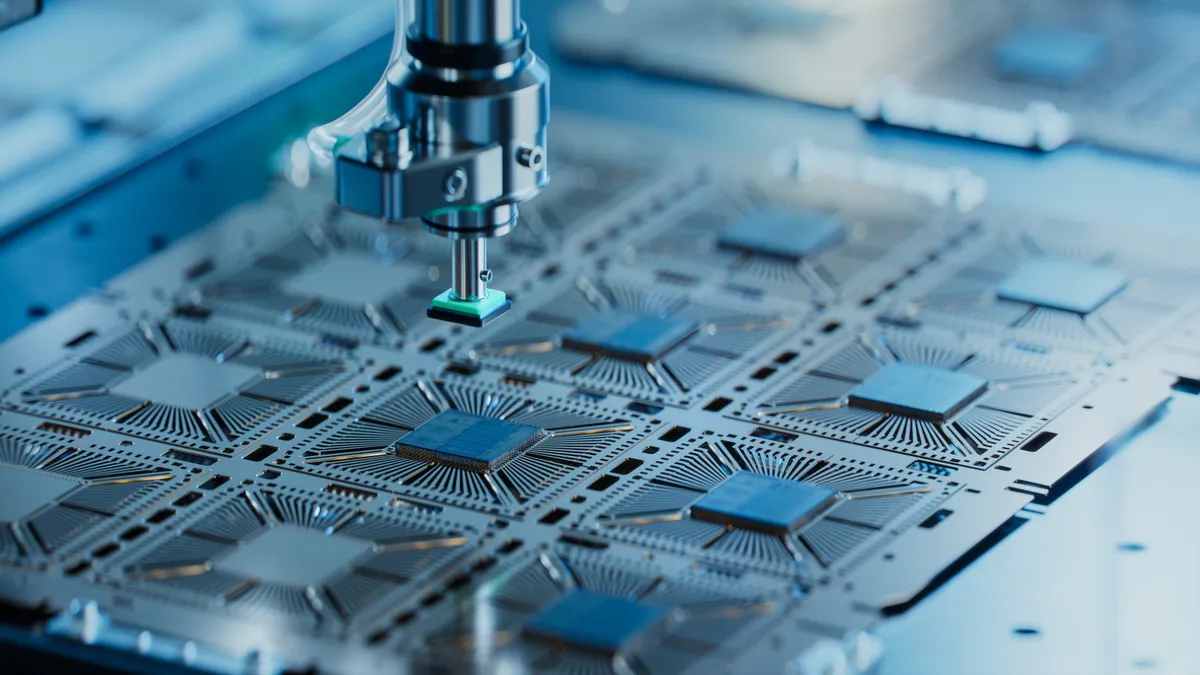

- On the heels of the CFO change, GlobalFoundries on Tuesday announced it would be making a 1.1 billion euro (approximately $1.3 billion USD) investment to expand its manufacturing site in Dresden, Germany. The investment will “enable a production capacity increase to more than one million wafers per year by the end of 2028, making it the largest site of its kind in Europe,” the company said in the release.

Dive Insight:

Hollister is departing from the chipmaker after just over a year in its top financial seat, succeeding David Reeder as GlobalFoundries’s finance chief last February. Prior to GlobalFoundries, he served in several roles for fellow semiconductor manufacturer Silicon Labs during his two-decade tenure, including 11 years as its finance chief, according to his LinkedIn profile.

His interim successor Franklin joined GlobalFoundries in September 2022 as its VP of capital markets, treasury and investor relations, and has held his current SVP role since November 2023, according to his LinkedIn profile. His previous roles include serving as SVP, direct investments for United Arab Emirates sovereign investor Mubadala, as well as serving as a director for MUFG.

Franklin is stepping in to the interim CFO role as GlobalFoundries moves forward with its expansion plans, coming as various global powers including the U.S., the European Union and China vie for first place in the ongoing chip race. As evolving artificial intelligence tools, changing trade policies and supply chain hiccups have continued to impact chip demand, both the U.S. and the EU have moved to bolster their competitiveness in the growing semiconductor space.

The EU is considering revisions to the Chips Act it passed in 2023, according to a recent Reuters report, while the U.S. government invested $8.9 billion in chipmaker Intel — taking a 10% stake in the company, according to an August press release.

Known as “Project SPRINT,” GlobalFoundries’ planned expansion for its German facility in Dresden is expected to be supported both by the German federal government, and the state of Saxony under the EU Chips Act, according to the Tuesday release. EU approval for the full program is expected later this year, the company said.

“Recent disruptions in the automotive sector underscore just how vulnerable global chip supply chains truly are. Our planned expansion in Dresden is yet another step in GF’s strategy to address these challenges head-on and deliver on our commitment to support Europe’s need for secure supply chains and differentiated technologies,” Tim Breen, CEO of GlobalFoundries said in a statement included in the release.

German automaker Volkswagon, for example, recently warned of temporary production outages due to recent semiconductor export restrictions from China, and stated they might see “significant production restrictions” if the supply challenges were not resolved speedily, CNBC reported.

In its most recent earnings call, company executives pointed to the ongoing impact of tariffs and other trade policies on the chip industry, with then CFO Hollister noting GlobalFoundries was “diligently managing the potential supply chain cost impacts associated with tariff uncertainties,” according to an earnings transcript.

“Thanks to GF's global footprint and diversified sourcing strategy, we expect the cost impacts to be limited to roughly $20 million in the second half of 2025,” Hollister said.

For its second quarter ended June 30, the chipmaker reported revenue of $1.68 billion, a 3% increase year-over-year, according to its earnings report. Net income, meanwhile, rose by 47% YoY to hit $228 million. On Monday, GlobalFoundries reaffirmed its previously issued guidance for its upcoming third quarter, with results slated to be released Nov. 4. For its Q3, GlobalFoundries expects net revenue around $1.67 billion, it said in its Q2 results released Aug. 5.

GlobalFoundries did not immediately respond to requests for comment.