Mobility is fast becoming the engine of enterprise transformation. Advances in electrification, automation, and intelligent connectivity are rewiring how organizations move people and goods and how those movements flow through the balance sheet.

According to The Great Mobility Shift: The next era of automotive transformation, this change is accelerating faster than expected. Traditional fleet ownership is giving way to connected, data-driven ecosystems that operate more like digital networks than fixed assets. That means mobility is no longer a back-office cost. It’s a strategic tool that can drive profitability, sustainability, and long-term value creation.

Here are some of the emerging mobility trends that will reshape how you think about cost, risk, and value.

Electrification: From mandate to margin

Fleet electrification is nearing its tipping point. Global EV sales topped 17 million units in 2024, more than 20% of all new vehicles, and are projected to hit 25% by 2030. As battery costs fall and range improves, the total cost of ownership for many commercial use cases now rivals internal-combustion vehicles.

Next-generation chemistries, from sodium-ion to solid-state, are extending life cycles and reducing reliance on rare minerals. Wireless and vehicle-to-grid charging could soon let fleets sell energy back to utilities. “Smart charging infrastructure should be viewed as an investment asset, not just a utility expense,” says Dr. Sheldon Williamson, Professor of Electrical, Computer and Software Engineering at Ontario Tech University.

Electrification planning means more than vehicle purchases. It includes charging networks, grid partnerships, depreciation tied to battery health, and energy-contract management. The upfront spend is significant, but so are the lifetime savings and sustainability-related gains.

Automation: Expanding utilization and reshaping ROI

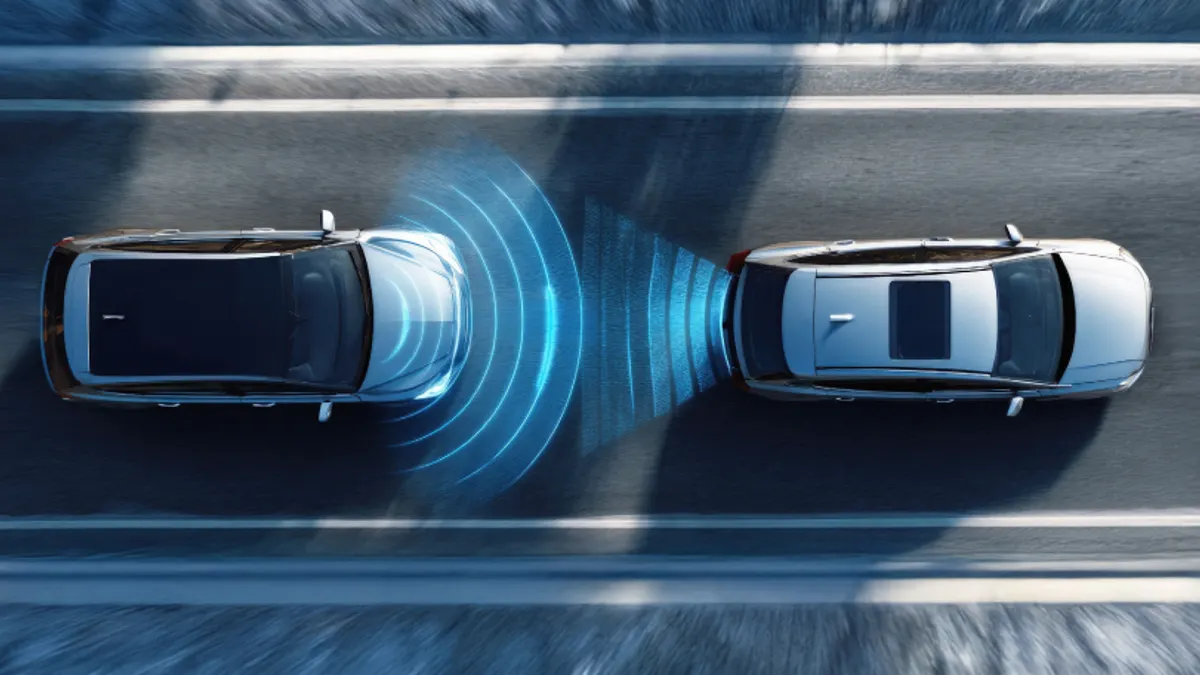

Autonomous technology is moving quickly from pilot to practice. Automated systems are already improving safety and efficiency in controlled environments such as ports and logistics corridors. The whitepaper projects the global autonomous-vehicle market to reach $214 billion by 2030, driven largely by commercial fleets.

The real power of automation comes down to time and precision. Vehicles that stay on the road longer and take the most efficient paths naturally deliver stronger returns. As Professor David Levinson notes, automation marks “a fundamental change from vehicles as owned assets to vehicles as services.”

As a finance leader, you gain more room to maneuver on the balance sheet. Leasing, subscription, and pay-as-you-go models let you match costs more closely with performance.

AI and connectivity: Turning data into decision power

Connected technology is transforming fleet data into a financial advantage. Telematics, IoT sensors, and AI analytics now provide continuous insight into vehicle health, driver behavior, and route performance. Predictive maintenance and intelligent routing can reduce downtime by up to 30% and cut fuel or energy costs by double digits.

The challenge is integration. As the whitepaper highlights, AI-enabled systems often cost two to three times more upfront than GPS-only tools because of the work required to link legacy systems.

For you, that means budgeting for data governance, training, and cybersecurity, not just software licenses. When fully integrated, connected intelligence gives finance teams live visibility into costs, utilization, and ROI.

Embedded and on-demand mobility: Access over ownership

The next evolution in fleet economics is already taking shape through embedded and shared mobility. Businesses are just now beginning to bundle transportation directly into their services. This includes hotels bundling airport transfers, property managers offering mobility credits with leases, or companies outsourcing their entire fleet through subscription or “mobility-as-a-feature” models.

This shift replaces capital expenditure with flexible operating costs. Instead of tying up balance-sheet capital in vehicles, organizations can access transportation as a service, scaling up or down with demand.

The CFO’s new mobility mandate

Mobility now touches nearly every aspect of financial leadership:

- Capital optimization: You can compare ownership versus service models to preserve liquidity and align cost with usage.

- Risk management: You need to account for new exposures in automation, cybersecurity, and energy dependence.

- Operational efficiency: You can use predictive analytics to cut downtime and improve asset performance.

The message from The Great Mobility Shift: The next era of automotive transformation is clear: mobility transformation is a financial strategy. CFOs who plan for it today by aligning technology, capital, and sustainability goals will turn the next decade of disruption into an opportunity for growth.

Download the full whitepaper to see how you can turn fleet modernization into a financial advantage.