Financial Reporting: Page 47

-

FASB calls for comments on tax credit change

The move marks another step toward simplifying accounting rules related to Renewable Energy Tax Credits and several other credit programs.

By Maura Webber Sadovi • Aug. 22, 2022 -

Walmart CFO eyes payments opportunities

With PayPal’s former CFO on board, the retail behemoth is assessing its prospects in the payments arena near and far.

By Lynne Marek • Aug. 22, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineCFO best practices in the evolving generative AI era

As the initial frenzy around the launch of generative artificial intelligence subsides, a new GenAI era appears to be taking shape.

By CFO Dive staff -

Sponsored by Center for Audit Quality

The accounting profession is making bold moves to increase diversity

The CAQ surveyed nearly 4,000 students and found that Black and Hispanic business majors who have considered accounting degrees perceive several barriers to entering the profession. Leaders in the field are taking action and investing in change.

Aug. 22, 2022 -

EY requests ‘immediate’ Treasury tax guidance on split-offs

Accountants and tax-preparers are just beginning to grapple with the ramifications of the new 15% Corporate Alternative Minimum Tax.

By Maura Webber Sadovi • Aug. 19, 2022 -

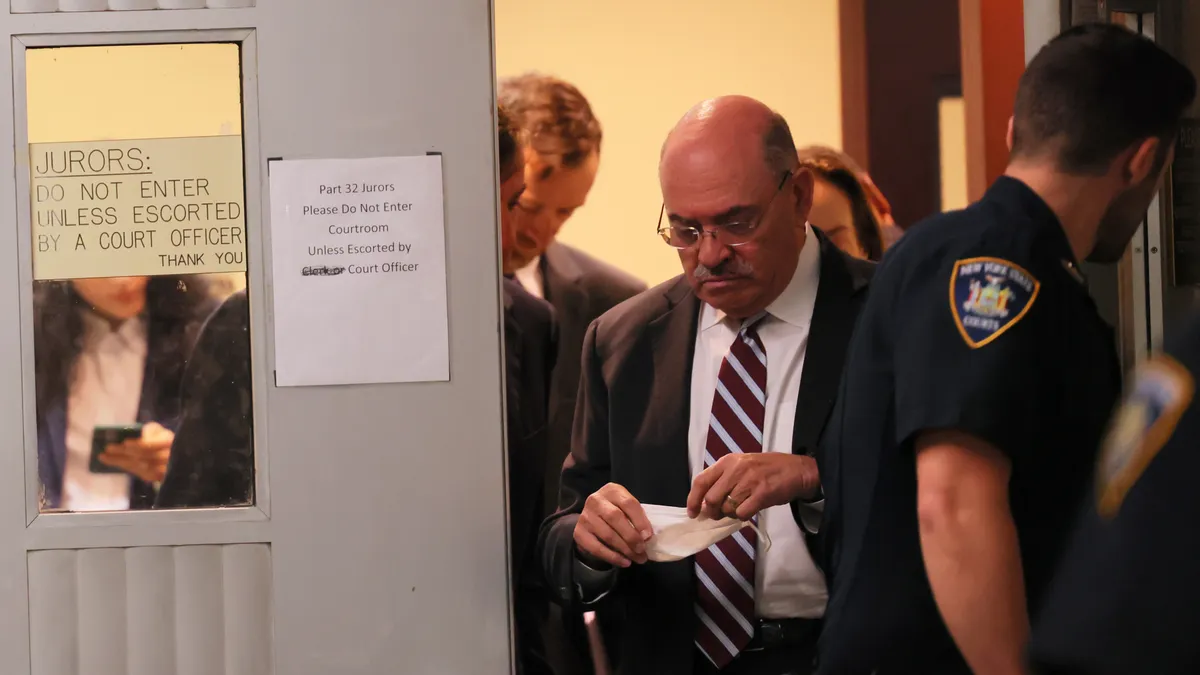

Former Trump CFO pleads guilty in tax scheme

At the core of the charges that Trump Organization executive Allen Weisselberg pleaded guilty to Thursday is a scheme to evade income taxes by hiding compensation.

By Maura Webber Sadovi • Aug. 18, 2022 -

SEC accepts crypto update to GAAP taxonomy

The accounting changes come as crypto-asset valuations have taken a beating and drawn increasing regulatory scrutiny.

By Maura Webber Sadovi • Aug. 17, 2022 -

Walmart CFO aims for market share as shoppers trade down

The retail giant’s pricing strategy — geared to budget-conscious consumers — includes plans for an under-$50 Thanksgiving meal for four.

By Maura Webber Sadovi • Aug. 16, 2022 -

Home Depot gains record profit on home improvement craze

Home Depot reported record Q2 revenue, with homeowners’ strong balance sheets helping the company to navigate successfully through inflationary pressures.

By Grace Noto • Aug. 16, 2022 -

China’s economic ills persist under COVID-19 lockdowns

Rising COVID-19 cases and record youth unemployment saw China’s economy slump in July, further clouding its growth outlook for the year.

By Grace Noto • Aug. 16, 2022 -

Akumin terminates CFO per transformation plan

With the hiring of a global business transformation specialist as Akumin’s interim CFO, William Larkin is fired from the top financial seat.

By Elizabeth Flood • Aug. 15, 2022 -

Sonos CFO departs for Taser-maker Axon

CFO Brittany Bagley exits Sonos following disappointing fiscal third quarter revenue results, with the speaker company partially blaming inflation for a lackluster quarter.

By Elizabeth Flood • Aug. 11, 2022 -

Bankrupt Revlon to pay $165,000 monthly for interim CFO

Alvarez & Marsal Managing Director Matt Kvarda will step in as interim CFO for beauty brand Revlon as it goes through corporate restructuring, with the consulting firm reaping a $165,000 monthly fee.

By Grace Noto • Aug. 10, 2022 -

Brink’s taps Eaton, PwC veteran as CFO

The Brink's Company, know for its iconic trucks that transport cash, has tapped a new CFO as its long-time finance chief prepares to retire.

By Elizabeth Flood • Aug. 10, 2022 -

IFF CFO sees ‘meaningful’ cost increases next year

International Flavors & Fragrances CFO said the ingredient maker is rethinking contracts as part of its effort to combat inflation.

By Maura Webber Sadovi • Aug. 9, 2022 -

Retrieved from Unsplash on July 22, 2021

Retrieved from Unsplash on July 22, 2021

AMC Networks promotes CFO to CEO, names new finance chief

Patrick O’Connell is joining AMC as CFO while the current finance chief moves up the ladder.

By Elizabeth Flood • Aug. 9, 2022 -

Tanger REIT continues CFO hunt, highlights ESG

Two months after announcing the abrupt departure of James Williams, Tanger REIT is continuing its CFO search.

By Grace Noto • Aug. 9, 2022 -

Companies reporting weak earnings go unpunished

Several CFOs have announced disappointing second-quarter earnings while not triggering a decline in their company’s share price, FactSet said.

By Jim Tyson • Aug. 8, 2022 -

Plummeting tech valuations lead to record $23B SoftBank loss

The slump in global technology stocks, rising inflation and a weaker yen led Japanese bank SoftBank to report a record $23 billion loss.

By Grace Noto • Aug. 8, 2022 -

Bankrupt Celsius pulls bid to hire ex-CFO

Cryptocurrency firm Celsius pulls motion to tap its former CFO as a bankruptcy advisor following legal objections filed from investors.

By Grace Noto • Aug. 8, 2022 -

Just 9% of finance departments have primary ESG oversight: survey

Evidence of loose internal controls related to environmental, social and governance (ESG) data comes as the potential cost of companies getting ESG reporting wrong are rising.

By Maura Webber Sadovi • Aug. 5, 2022 -

WeWork plans to raise rates in stronger markets

CFOs are wrestling with how much to spend on office real estate as the shift to hybrid work has accelerated.

By Maura Webber Sadovi • Aug. 4, 2022 -

SEC should require global tax disclosure: transparency group

Spotty public disclosure by U.S. companies on foreign tax risk may erode investor confidence and increase the odds of financial market instability, according to the FACT Coalition.

By Jim Tyson • Aug. 4, 2022 -

Bankrupt Celsius, investors clash over former CFO advisory role, allege double dipping

Investors are taking steps to block Celsius from tapping former CFO Rod Bolger as a bankruptcy advisor, a bid that comes with a costly $92,000 monthly price tag for the insolvent company.

By Grace Noto • Aug. 4, 2022 -

PayPal hands new CFO $6M cash hiring bonus

The PayPal CFO's new-hire bonus comes as some companies are using more cash-rich compensation packages to land finance chiefs.

By Maura Webber Sadovi • Aug. 3, 2022 -

Inflation brings new drivers to Uber in cash flow positive quarter

Inflation is nudging new drivers and couriers to Uber as the company posts record driver base figures and its first cash flow positive quarter.

By Grace Noto • Aug. 2, 2022