Strategy & Operations: Page 75

-

After record year, time for CFOs to rethink aggressive buybacks

Bad timing can turn what should be a financial booster into a long-term negative ROI, a veteran management consultant says.

By Ted Knutson • April 6, 2022 -

IPOs in Americas plummet 72% during first quarter: EY

High inflation, stock market turbulence and Russia’s invasion of Ukraine prompted a slump in initial public offerings during the first quarter.

By Jim Tyson • April 5, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital transformation, one smart step at a time

As pricing pressures tighten margins and technologies like agentic AI evolve, finance chiefs are more closely scrutinizing the cost and returns of the tech tools they implement.

By CFO Dive staff -

Automation could be end result of Starbucks buyback pause

Although employees stand to benefit from the coffee giant’s decision to invest money in its operations, the company remains unfriendly to unionization.

By Robert Freedman • April 5, 2022 -

Spencer Stuart's new CFO tracks Ukraine

Christine Laurens is now a three-time CFO even as women still only accounted for 15.1% of CFOs at major companies last year.

By Maura Webber Sadovi • April 4, 2022 -

Opinion

3 steps to finding Zen in unmanaged spend

Finance departments have thought of unmanaged spend as a problem rooted in how well we track purchases, enforce T&E policies and consolidate vendors, but the human element is the big factor.

By Adriana Carpenter • April 1, 2022 -

M&A slumps 23% during first quarter amid headwinds

Geopolitical tensions, threats to economic growth and other risks discouraged deal-makers during the first three months of 2022, according to Refinitiv.

By Jim Tyson • April 1, 2022 -

Outsourced middle-office services gaining traction with CFOs

CFOs can expose their in-house staff to the newest technology and best practices by augmenting their processes with managed services, consultants say.

By Ted Knutson • March 31, 2022 -

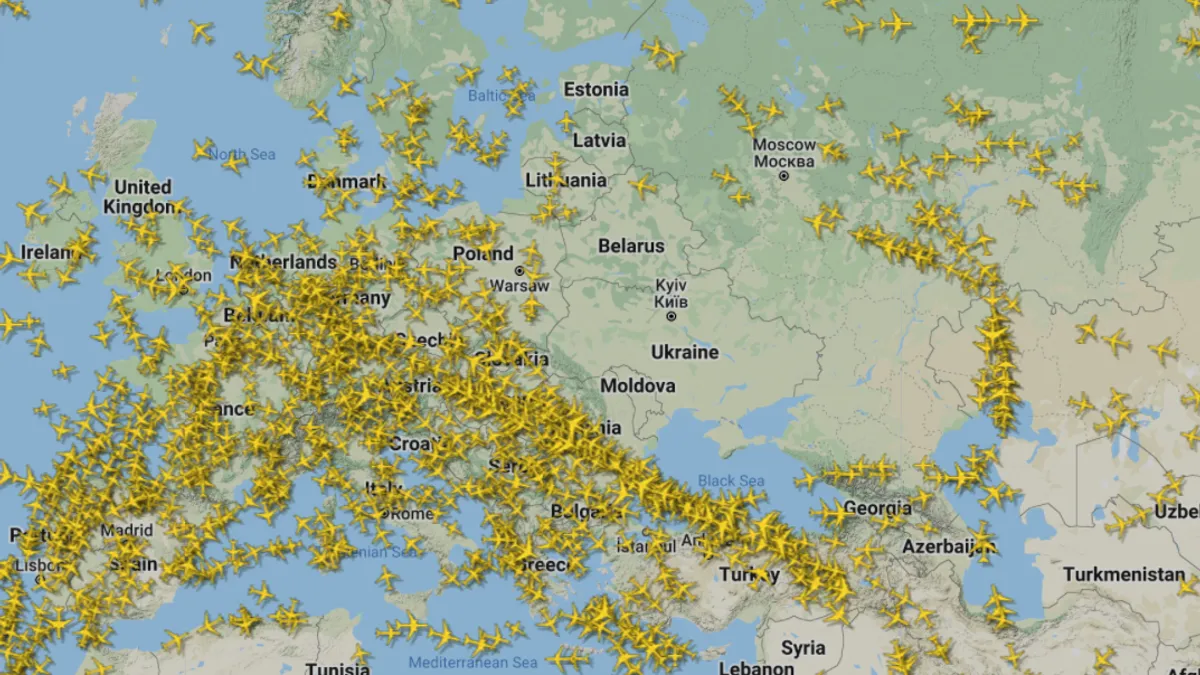

Retrieved from Flightradar24 on March 04, 2022

Retrieved from Flightradar24 on March 04, 2022

Geopolitical tensions, inflation dim CFOs' economic outlook: Deloitte

CFOs are entering 2022 with lower expectations for the economy and their business prospects, according to a Deloitte survey.

By Kaishi Chhabra • March 30, 2022 -

100% bonus depreciation for company jet ends this year

Starting in 2023, bonus depreciation drops annually by 20% increments and conventional accelerated depreciation fills in the balance.

By Robert Freedman • March 29, 2022 -

Surging inflation compelling small businesses to raise prices

Inflation is broad based – flaring in every sector – and will probably persist longer than initially expected, the U.S. Chamber of Commerce said.

By Jim Tyson • March 29, 2022 -

Cyber extortion surges 78% on spread of 'ransomware-as-a-service'

Ransomware attacks are becoming more sophisticated and, at most companies, require a recovery period of more than a month, according to Palo Alto Networks.

By Jim Tyson • March 28, 2022 -

Crypto firm Abra's new CFO digs into war for talent

Justin McMahan joins a growing number of executives leaving more mainstream finance companies to helm the finances at crypto-focused firms.

By Maura Webber Sadovi • March 28, 2022 -

Sponsored by Inmar Intelligence

4 ways to boost profits by minimizing deduction leakage

In this piece, we focus on how to minimize and prevent deduction leakage as part of a larger margin preservation strategy.

March 28, 2022 -

Minority of CFOs see metaverse transforming their companies

While many financial executives have made big investments in cloud computing to support remote work in the pandemic, a growing number of large companies are now signaling their interest in the metaverse by filing related trademark applications.

By Maura Webber Sadovi • March 25, 2022 -

Biden tightens Russia sanctions as supply chain recovery falters

The prices of oil, metals and other commodities have surged since the start of Russia’s invasion of Ukraine, complicating efforts by CFOs to overcome the harm from supply chain disruptions.

By Jim Tyson • March 24, 2022 -

Opinion

3 ways recurring revenue can fund business growth

Investors are starting to recognize a company's recurring-revenue stream as an asset that can be traded in exchange for up-front capital, a fast, non-dilutive alternative to equity.

By Harry Hurst • March 24, 2022 -

Item 9 CFO relishes fight to normalize cannabis industry

"We have new problems to solve every day to normalize the industry and get it out of the back alley,” Item 9 Labs CFO Bobby Mikkelsen said.

By Maura Webber Sadovi • March 24, 2022 -

Acquisition of bankrupt companies poised to surge this year

One advantage to buying a target business while it’s in bankruptcy is the court’s sale order, which helps ensure the buyer has title to the assets without concerns creditors will assert claims.

By Ted Knutson • March 23, 2022 -

Internet of Things forces rethink of KPIs: McKinsey

The Internet of Things may unlock as much as $12.6 trillion in value by 2030 if companies weave the technology into their operations, McKinsey said.

By Jim Tyson • March 22, 2022 -

Hardening cloud against 'bad actors' eclipses budget concerns: BDO

Over the past two years of hybrid work, multiple external devices accessing company networks and the shift away from the "castle-and-moat" structure has turned the cybersecurity landscape upside down, BDO's Steve Combs said.

By Maura Webber Sadovi • March 22, 2022 -

CRISPR pioneer's biotech taps ex-Barclays banker as CFO

Scribe Therapeutics was co-founded by Jennifer Doudna, who shared the 2020 Nobel Prize in Chemistry for the discovery of CRISPR, the genome editing technology.

By Maura Webber Sadovi • March 21, 2022 -

Sponsored by Protiviti

Stop kicking the can: Why companies must think long term to solve supply chain challenges

Learn how this partnership between supply chain and finance teams can lead to their supply chain becoming more resilient, flexible and predictive over time.

By David Petrucci, Managing Director Supply Chain Global Leader and Tim Bulman, Managing Director Business Performance Improvement • March 21, 2022 -

CarParts.com promotes CFO in C-Suite shakeup

With over 300,000 square feet of warehouse space coming online over the next two quarters and a record inventory level, the company is sticking with its strategy of loading up on products to win customers.

By Maura Webber Sadovi • March 17, 2022 -

'Fourth-party risk' rising during supply chain disruption

Businesses seeking to curb the threats from cyberattacks, high inflation and pandemic interruptions confront an added layer of risk from sub-contractors, KPMG said.

By Jim Tyson • March 17, 2022 -

Companies settle on hybrid return-to-office model

After embracing remote work, both employers and employees see social interaction as integral to satisfaction and performance.

By Robert Freedman • March 16, 2022