Strategy & Operations: Page 79

-

Sponsored by Infosys BPM

Divestitures – the ace of a tool up a CFO's arm to survive and thrive in crises

The crisis of the pandemic has surely left companies across sectors with unprecedented challenges in the face of a tepid economic situation. In such a scenario, finance leaders are uniquely positioned to lead the path to recovery for companies by instilling a cash culture across the organization ...

By Lalitha Narni, Senior Domain Principal & Raman Deep Kedia, Domain Principal, Infosys BPM • Jan. 18, 2022 -

Photo by Ketut Subiyanto from Pexels

Conductor's first female CFO pushes her own boundaries to join former WeWork company

A self-described risk-averse person by nature, Conductor's Sherri Moyen says she's been inspired by Sheryl Sandberg and others to choose risk over comfort.

By Maura Webber Sadovi • Jan. 14, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital transformation, one smart step at a time

As pricing pressures tighten margins and technologies like agentic AI evolve, finance chiefs are more closely scrutinizing the cost and returns of the tech tools they implement.

By CFO Dive staff -

Deep Dive

8 CFO tips for pursuing M&A amid dealmaking 'fever'

M&A will probably surge this year after a record 2021, and CFOs who want to prevail in the highly competitive market should follow several best practices.

By Jim Tyson • Jan. 14, 2022 -

Workiva's Klindt sees regulations as key to more ESG buy-in

Anticipated SEC rules on ESG reporting could bring more firms off the sidelines.

By Maura Webber Sadovi • Jan. 13, 2022 -

Bad use of FP&A costs U.S. companies $7.8B a year

The losses stem from innovation that doesn’t happen and the hours analysts spend using siloed, manual, error-prone data processes, a research collaboration between the University of Baltimore and DataRails finds.

By Robert Freedman • Jan. 13, 2022 -

'Friendly fraud' risks messing up CFOs' metrics

Consumers taking advantage of gaps in online processes can make it hard for companies to track how well they’re doing.

By Robert Freedman • Jan. 12, 2022 -

Increasingly strategic CFOs are in the room where back-to-office plans happen – or don't

Financial executives are being tasked with a much broader set of responsibilities across their companies, according to Steve Gallucci, global and U.S. CFO program leader at Deloitte.

By Maura Webber Sadovi • Jan. 12, 2022 -

Powell hints at Fed's inflation moves, digital currency in hearing

Analysts expect Fed officials to make three or four interest rate increases in 2022. At least two Fed regional presidents — Loretta Mester in Cleveland and Raphael Bostic in Atlanta — have said an increase in March would be appropriate.

By Dan Ennis • Jan. 12, 2022 -

Salary for top-end, big-city, big company CFO close to $570,000

Salaries can be considerably lower for finance leaders in smaller metro areas even if they’re in a large company, according to staffing firm Atrium, which surveyed New York City companies.

By Robert Freedman • Jan. 11, 2022 -

CFOs chase down payments, eye inventory, grip cash amid halting recovery

After realizing a win by reducing the average days to payment, financial executives are looking to rationalize inventory, according to Craig Bailey of The Hackett Group.

By Maura Webber Sadovi • Jan. 10, 2022 -

Pension plans gain while facing headwinds in 2022: Goldman

Companies this year will likely “de-risk” their pension plans by shifting more capital into fixed-income assets, Goldman Sachs Asset Management said.

By Jim Tyson • Jan. 7, 2022 -

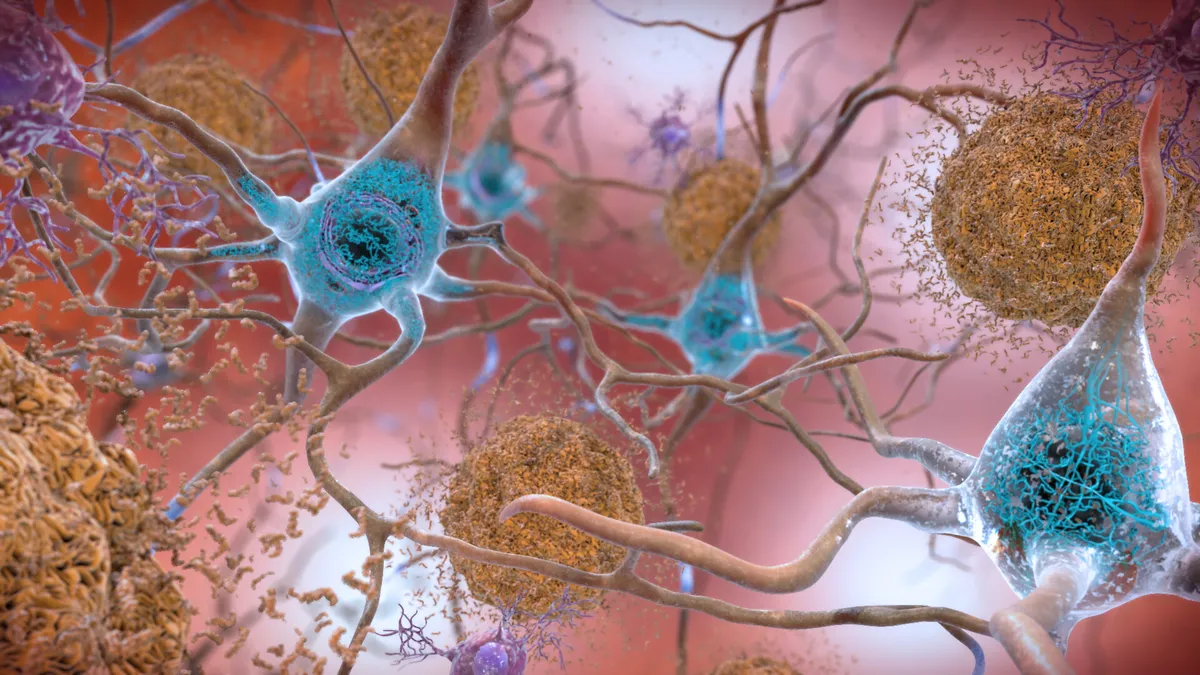

National Institute on Aging. (2017). "Beta-Amyloid Plaques and Tau in the Brain" [Image]. Retrieved from Flickr.

National Institute on Aging. (2017). "Beta-Amyloid Plaques and Tau in the Brain" [Image]. Retrieved from Flickr.

Annovis Bio CFO looks to shelf registration, big pharma for capital runway

While investor enthusiasm for the Alzheimer's treatment space has flip-flopped, CFO Jeffrey McGroarty has shored up a capital lifeline through a shelf registration.

By Maura Webber Sadovi • Jan. 7, 2022 -

M&A in 2021 lifts buyers' stock prices most in five years

Companies pursued a record number of large deals last year while scoring market gains, according to a study by Willis Towers Watson.

By Jim Tyson • Jan. 6, 2022 -

SPAC-bound SoundHound taps CRO, looks to turn up sales, revenue volume

With voice AI projected to be a $160 billion market, newly tapped chief revenue officer Zubin Irani is looking to land more platform users.

By Maura Webber Sadovi • Jan. 4, 2022 -

Sale leasebacks worth a look for raising capital, say specialists

Real estate funds and REITs are looking to allocate capital quickly, and these transactions can be closed in as little as 45 days.

By Ted Knutson • Dec. 30, 2021 -

E-commerce subscription CFO hews to patient capital allocation plan

Stephanie Lemmerman has a long-game capital spending strategy for investing growth capital and avoiding unhealthy cash burn territory.

By Maura Webber Sadovi • Dec. 23, 2021 -

How Samsara achieves high margins despite hardware costs

The company gets 72% gross margins by encouraging customers to accept long-term contracts that enable it to amortize costs over years, a smart strategy, says SaaS specialist Jason Lemkin.

By Robert Freedman • Dec. 22, 2021 -

How HaystackID's new CFO is prepping for growth

Dave Murray's first task is integrating into a single ERP system the accounting operations of half a dozen acquisitions the company has made.

By Maura Webber Sadovi • Dec. 21, 2021 -

CFO touts controller role as crypto-enabler expands footprint

Managing complexity with a small team requires an accounting head that’s comfortable in both inward- and outward-focused roles, Coinme finance chief Chris Roling says.

By Robert Freedman • Dec. 20, 2021 -

How 2021's restaurant IPOs have performed so far

From Dutch Bros' booming IPO to Krispy Kreme's less-than-stellar initial stock performance, these are the companies that went public this year.

By Julie Littman • Dec. 20, 2021 -

CFOs rank 'retention, retention, retention' as top priority for 2022: Deloitte

Intense competition for workers has prompted CFOs to plan improvements in hiring and retaining employees during 2022, Deloitte found in a survey.

By Jim Tyson • Dec. 16, 2021 -

Structuring options might have helped Five9 merger, Zoom CFO says

Thinking back to Zoom’s unsuccessful effort to merge with the contact center solution company, Kelly Steckelberg said some "mechanics" like a collar might have helped make a deal workable.

By Robert Freedman • Dec. 14, 2021 -

CFOs fall short of meeting investors' ESG reporting needs: EY

CFOs need to close a "reporting gap" with investors by providing more information on company sustainability performance, EY said.

By Jim Tyson • Dec. 14, 2021 -

M&A boom will surge into 2022: KPMG

Easy money, labor shortages and ample investment capital will probably stoke dealmaking next year well beyond 2021 levels, KPMG says.

By Jim Tyson • Dec. 13, 2021 -

Congress unlikely to dampen record stock buybacks

After hitting a low during the early days of COVID-19, company share repurchase programs are surging despite lawmakers putting the practice in their sights.

By Robert Freedman • Dec. 13, 2021