Strategy & Operations: Page 89

-

Twitter CFO: Don't let strategy drown out operations

Technology will take over more functions, but finance should stay close to the numbers, Ned Segal said.

By Robert Freedman • April 22, 2021 -

Businesses can only expect limited boost from stimulus checks: Fed study

Households have channeled federal stimulus checks primarily towards savings or reducing debt, giving businesses just a limited lift from consumer spending, according to the Fed.

By Jim Tyson • April 22, 2021 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital transformation, one smart step at a time

As pricing pressures tighten margins and technologies like agentic AI evolve, finance chiefs are more closely scrutinizing the cost and returns of the tech tools they implement.

By CFO Dive staff -

REPAY's 2019 SPAC deal enabled leadership to control own destiny

The digital payments company's IPO merger generated a lucrative exit for investors, CFO Tim Murphy said.

By Robert Freedman • April 21, 2021 -

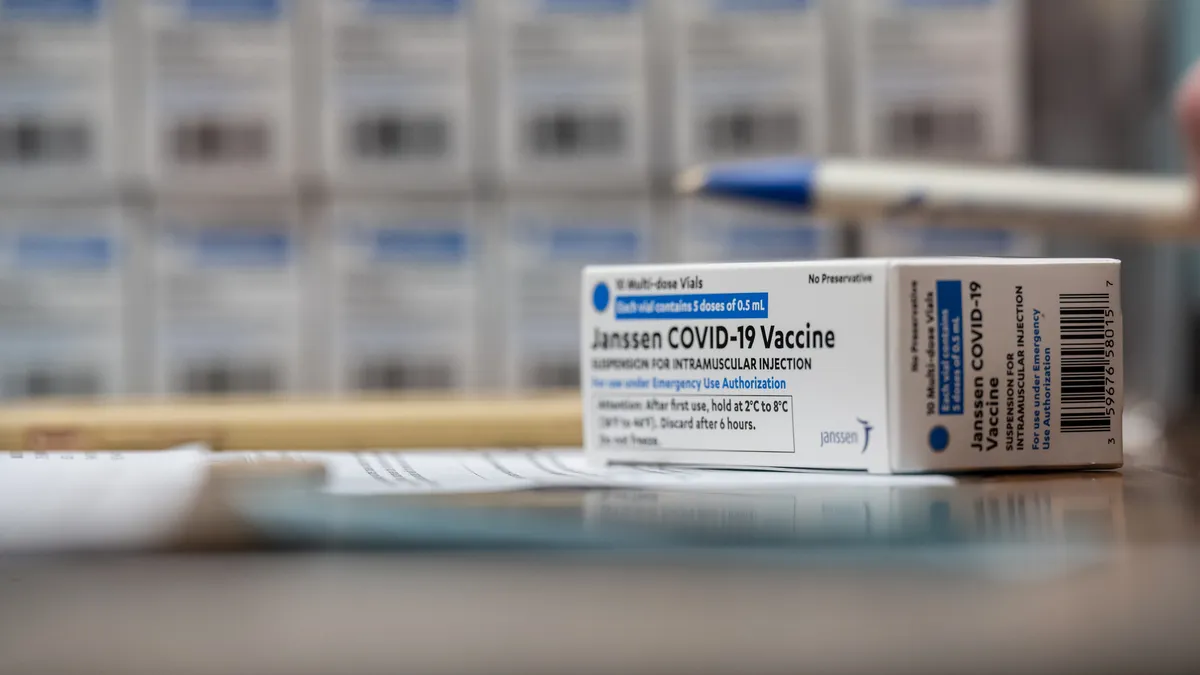

Johnson & Johnson stronger today than pre-pandemic, CFO says

Despite the setback with its COVID-19 vaccine, the company has seen sales across its product lines increase almost 8%, Joseph Wolk said as the biopharma giant shared its first quarter results Tuesday.

By Jane Thier • April 21, 2021 -

As travel resumes, Expedia CFO prioritizes marketing spend

After cutting costs and initiating three rounds of layoffs in 2020, Eric Hart, who leads strategy and finance for the online travel site, said brand and performance marketing spending will be a priority going forward.

By Jane Thier • April 19, 2021 -

Sponsored by EY

How to improve your capital allocation with an outside-in view

With increasing stakeholder pressure, CFOs can apply an outside-in lens to capital allocation.

By Loren Garruto • April 19, 2021 -

New Blaze Pizza CFO: 'We all have to assume the world will get back to normal'

Brad Reynolds left the ghost kitchen industry for fast-casual, a beleaguered restaurant segment he believes is poised for a comeback, he told CFO Dive.

By Jane Thier • April 16, 2021 -

Deep Dive

SEC cybersecurity tactics point to ESG approach, attorney says

As the Securities and Exchange Commission builds investor protections on sustainable investing, CFOs can look to the agency's approach to cybersecurity for hints on how to prepare for disclosure rules and enforcement actions.

By Jim Tyson • April 15, 2021 -

Senate confirms Gensler to lead SEC in 53-45 vote

While leading the Biden administration’s watchdog of Wall Street, Gensler is expected to toughen aspects of oversight that were eased during the Trump administration.

By Jim Tyson • April 14, 2021 -

Opinion

Despite gains in hard-hit sectors, be realistic on valuations

The outlook across sectors is better than expected, but forecasts must be achievable.

By Brian Garfield • April 14, 2021 -

CFO hit home run as Mets assistant controller

Rebecca Mahadeva is bringing to the healthcare advertising industry the same accounting efficiencies she brought to the storied New York ball club.

By Robert Freedman • April 13, 2021 -

Former NYSE CFO: SPACs are 'here to stay'

Special purpose acquisition companies “are starting to disintermediate late-stage venture capital," Amy Butte told CNBC Monday.

By Jane Thier • April 13, 2021 -

M&A supports buyers' stock price performance during Q1, study finds

Dealmaking paid off for acquiring firms, boosting their stock prices to a record first-quarter performance, a Willis Towers Watson study found.

By Jim Tyson • April 13, 2021 -

Weed out data before evolving finance tools, planning chief says

Teddy Collins of SeatGeek gave the company's data a hard look before transitioning finance tools from Excel to Google sheets to third-party applications.

By Robert Freedman • April 12, 2021 -

SEC in 'risk alert' warns that some ESG funds may mislead investors

The SEC found that some investment companies may have made misleading statements on ESG investing processes and adherence to ESG frameworks.

By Jim Tyson • April 12, 2021 -

Private credit markets poised to rebound: survey

Private credit dealmakers foresee a market resurgence in 2021 following the pandemic-induced setback last year, according to a survey by Katten.

By Jim Tyson • April 9, 2021 -

Model discounts into pricing, SaaS specialist says

Rather than leave discounting to a sales rep’s discretion, calculate strategically and offer transparent pricing, SaaStr founder Jason Lemkin says.

By Robert Freedman • April 8, 2021 -

Opinion

651 apps? How to get your SaaS stack in order

Software-as-a-Service applications help employees become more productive and innovative. But when unmanaged, too many applications can drain a technology budget and make collaboration difficult.

By Theresa O'Neil • April 8, 2021 -

Most companies will likely link executive pay to environmental targets: ING survey

Spurred on by the pandemic, most companies are accelerating their “green transformation” and plan to tie executive pay to environmental goals, ING said in an ESG survey.

By Jim Tyson • April 7, 2021 -

Coinbase's direct IPO could be hard act to follow

High name recognition and strong investor interest are needed to go public when there’s no big underwriter or a road show to generate excitement, a capital raise specialist says.

By Robert Freedman • April 7, 2021 -

Ahead of logistics business spinoff, XPO taps new CFO

The supply chain giant with clients including Nestlé, IKEA and Boeing on Tuesday named Baris Oran CFO of its soon-to-be spinoff company, GXO Logistics.

By Jane Thier • April 7, 2021 -

Yellen urges global policymakers not to withdraw stimulus too quickly

The lesson of the last financial crisis is to keep supporting the global recovery, the Treasury secretary said at the opening of a global economic meeting.

By Jim Tyson • April 6, 2021 -

New SaaS CFO to focus on deal pricing

Enterprise search technology company Sinequa is sitting on cash, freeing up finance chief Mark Williams to focus on growth, metrics, and deal support.

By Robert Freedman • April 6, 2021 -

Yellen pushes for global minimum corporate tax rate

Yellen deplores “a 30-year race to the bottom” in taxation and says a global minimum corporate tax rate would help bolster U.S. competitiveness.

By Jim Tyson • April 5, 2021 -

SEC accounting chief cautions on SPAC rush

The newly popular IPO alternative is often completed in months, a short time frame that can make public compliance rules hard to meet, a top federal official says.

By Robert Freedman • April 5, 2021