Treasury: Page 33

-

80% of companies passing on rising costs to consumers: Fed survey

CFOs face twin inflationary threats from labor shortages and disrupted supply chains. Their response: raise prices.

By Jim Tyson • Dec. 3, 2021 -

Fed's Quarles backs faster cuts in stimulus, citing inflation

The Fed may need to take extra measures to tighten monetary policy if inflation in the spring still exceeds 4%, Quarles said.

By Jim Tyson • Dec. 2, 2021 -

Small businesses raise wages at record pace

As inflation rises and "help wanted" signs go unanswered, CFOs are raising wages at the fastest rate in many years.

By Jim Tyson • Dec. 1, 2021 -

Fed may speed up cuts to stimulus amid inflation surge: Powell

The Fed will act if necessary to avert prolonged inflation pressures, which will probably persist through mid-2022, Powell said.

By Jim Tyson • Nov. 30, 2021 -

$1.7 trillion U.S. spending bill would not stoke inflation: Moody's

Concerns about the impact of the "social infrastructure" bill on inflation and the U.S. fiscal outlook may be overblown.

By Jim Tyson • Nov. 23, 2021 -

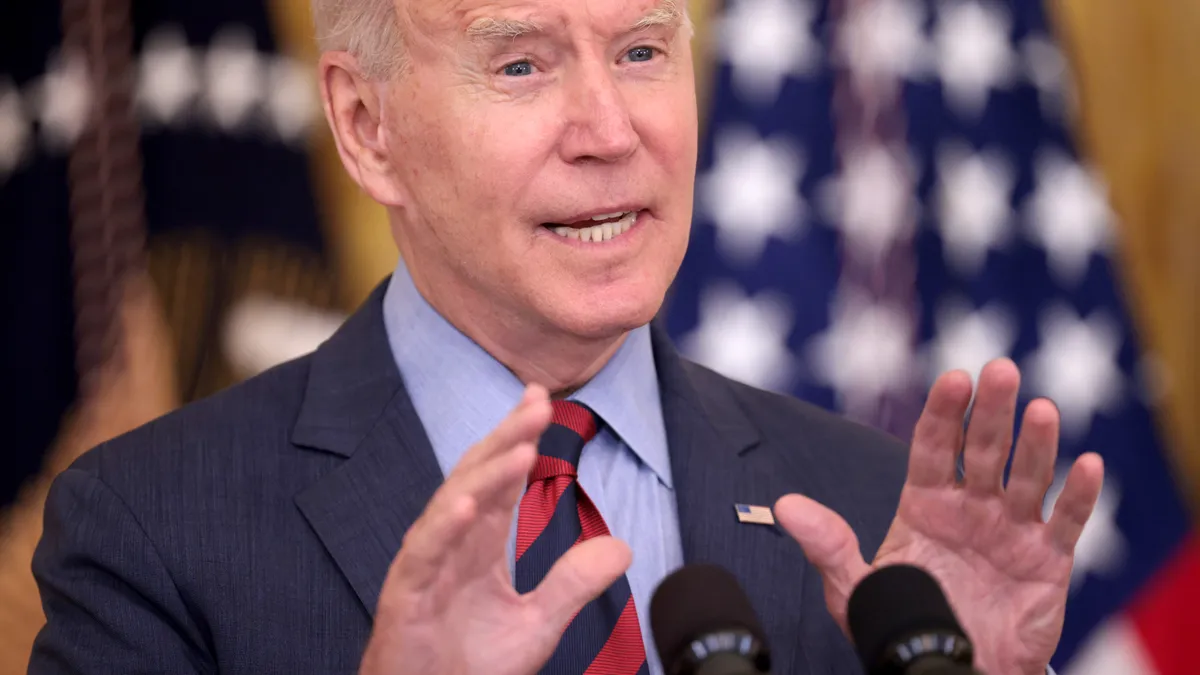

Biden taps Powell for second Fed term, supporting continuity

Biden's emphasis on monetary policy continuity is unlikely to discourage Powell from withdrawing record stimulus if inflation continues to accelerate.

By Jim Tyson , Dan Ennis • Nov. 22, 2021 -

Stripe CFO Suryadevara drawing from challenges as GM CFO

Suryadevara has ventured into unfamiliar business terrain before, becoming GM Treasurer with little prior knowledge of the role.

By Jim Tyson • Nov. 18, 2021 -

U.S. House panel passes bills tightening SPAC oversight

Two bills approved by the House Financial Services Committee signal support from lawmakers for tougher SEC regulation of SPACs.

By Jim Tyson • Nov. 17, 2021 -

6 CFO tips for freeing up cash, fighting inflation: McKinsey

With inflation running at a 30-year high, CFOs can identify dormant cash on their balance sheets and put it to use, McKinsey said.

By Jim Tyson • Nov. 16, 2021 -

CFOs fast track digital payments during pandemic

Digital payments have grown in popularity because of their role in helping ensure a healthy balance sheet, a survey found.

By Jim Tyson • Nov. 11, 2021 -

Proportion of businesses raising pay hits 48-year high: NFIB

Nearly half of small businesses can't fill job openings, and three out of four have either raised pay or plan to soon do so, a survey showed.

By Jim Tyson • Nov. 9, 2021 -

Inflation poses 'upside' risks: Fed official

By the end of next year, conditions will likely be set for the Federal Reserve to begin raising the benchmark interest rate, Fed Vice Chair Richard Clarida said.

By Jim Tyson • Nov. 8, 2021 -

ESG 'make-or-break' factor for leading investors: PwC

Most investors want companies to demonstrate a commitment to sustainability but would not tolerate a reduction in returns of more than one percentage point, PwC said.

By Jim Tyson • Nov. 1, 2021 -

Opinion

Uncertain times turn spotlight on corporate treasurers

As with CFOs, these behind-the-scenes executives are stepping up strategically to help their organizations navigate volatility.

By Meghan Birmingham Leader • Oct. 26, 2021 -

Retrieved from Senate Banking Committee.

Retrieved from Senate Banking Committee.

U.S. regulator warns of 'complacency' as LIBOR's end draws near

The phaseout of LIBOR is "an incredibly important issue facing the global financial system," a top U.S. regulator said.

By Jim Tyson • Oct. 26, 2021 -

Hedge fund sells holding in SPAC backing Trump as shares soar

Saba Capital divests of Digital World, a SPAC funding a Trump online venture, as retail investors rush to buy shares.

By Jim Tyson • Oct. 22, 2021 -

Deep Dive

11 CFO tips for riding the rising tide in ESG activism

CFOs eager to steer clear of shareholder activists should publicly embrace sustainability despite flaws in the measurement of best practices.

By Jim Tyson • Oct. 20, 2021 -

Fed-backed panel of companies urges quicker pace to LIBOR phaseout

A group of financial services companies echoed recent regulatory warnings about market instability and called for more robust efforts to wind down LIBOR before a Dec. 31 deadline.

By Jim Tyson • Oct. 14, 2021 -

Half of CFOs plan to assess digital currencies for business: Gartner

“Sentiment towards digital currencies appears to be improving among finance leaders,” a Gartner researcher said.

By Jim Tyson • Oct. 12, 2021 -

15% minimum global corporate tax faces obstacles: Tax Foundation

The Treasury pushed hard to gain approval from other countries for a 15% minimum global corporate tax, yet passage by Congress is far from guaranteed.

By Jim Tyson • Oct. 11, 2021 -

Companies expect surge in health care costs in 2022

Employees will probably step up their use of medical services after postponing routine care during the worst of the pandemic, says Willis Towers Watson.

By Jim Tyson • Oct. 6, 2021 -

End of LIBOR moving too slowly: Fed's Quarles

"The reign of LIBOR will end imminently, and it will not come back," says Fed Vice Chair Randal Quarles.

By Jim Tyson • Oct. 5, 2021 -

U.S. 'AAA' rating may face pressure from debt limit brinkmanship: Fitch

The partisan impasse over raising the debt ceiling showed no signs of easing on Monday as Fitch Ratings warned of pressure on the U.S. credit rating.

By Jim Tyson • Oct. 4, 2021 -

IPOs, mergers surge as dealmakers ride post-lockdown rebound

Executives considering IPOs should act without delay and take advantage of favorable and vulnerable market conditions, EY said.

By Jim Tyson • Sept. 30, 2021 -

Labor shortages may prolong inflation

The Federal Reserve may underestimate the impact of widespread labor shortages on inflation, central bankers say.

By Jim Tyson • Sept. 29, 2021