Compliance: Page 28

-

CFOs need to ‘get smart’ about ESG reporting

“ESG requirements are changing the landscape of corporate America,” said Lisa Edwards, president and chief operating officer of SaaS firm Diligent.

By Elizabeth Flood • Sept. 15, 2022 -

Private companies grapple with FASB lease accounting rules

Private companies have voiced concerns about the complexity of updated lease accounting rules, a FASB staff member reported Wednesday.

By Maura Webber Sadovi • Sept. 14, 2022 -

Trendline

Financial reporting enters a new age

Finance leaders are increasingly relying on metrics including churn, net promoter score and customer growth to reveal company performance in a way traditional GAAP measures cannot.

By CFO Dive staff -

Opinion

Intercompany ops: more than zero-sum game

For CFOs of growing companies, intercompany operations have increasing implications that extend across accounting, finance, tax, and treasury departments.

By David Brightman • Sept. 13, 2022 -

FASB to consider tweaking lease accounting guidance

Lease accounting is one of three major standards currently undergoing post-implementation reviews, according to FASB spokesperson Christine Klimek.

By Maura Webber Sadovi • Sept. 9, 2022 -

ESG ratings firms show ‘significant shortcomings’: study

ESG ratings providers, while gaining from rising demand for their assessments, are unreliable in gauging risk and return, Stanford University researchers said.

By Jim Tyson • Sept. 9, 2022 -

Gensler: securities laws cover ‘vast majority’ of crypto tokens

The SEC’s Gary Gensler signaled he would cooperate with the Commodity Futures Trading Commission to the extent that “it needs greater authorities with which to oversee and regulate crypto non-security tokens.”

By Maura Webber Sadovi • Sept. 8, 2022 -

Ammo Inc. suspends its CSO, GunBroker.com CFO after board blowup

The ammunition manufacturer has placed two executives, including the CFO of subsidiary GunBroker.com, on administrative leave following allegations of data and digital asset misappropriation.

By Grace Noto • Sept. 7, 2022 -

PCAOB finds audit flaws on fraud risk, SPACs

During the coming inspection period, the PCAOB’s so-called Target Team will focus on “risks related to climate change” that influence companies’ financial statements.

By Jim Tyson • Sept. 2, 2022 -

The modern challenges for CFOs

Mike Kelly of Ernst & Young (EY), talks talent retention, inflation, ESG reporting requirements and how these evolving issues are reshaping the top financial seat.

By Elizabeth Flood • Sept. 1, 2022 -

SEC pay-vs-performance rule called a chance to shape company story

The disclosures give executives a chance to put into perspective the strategy they’re following to increase long-term shareholder value.

By Robert Freedman • Sept. 1, 2022 -

FASB narrows cryptocurrency project scope, excludes NFTs

FASB has come around to recognizing the need for a better crypto accounting model as calls to safeguard investors against abuses rise.

By Maura Webber Sadovi • Aug. 31, 2022 -

Workers gain clout during pandemic: Gallup

CFOs face pressure to raise wages as the number of job vacancies far exceeds the number of unemployed people looking for work.

By Jim Tyson • Aug. 31, 2022 -

How adopting OKRs can help CFOs through a recession

When it comes to setting a company’s objectives, less is more, advises Gtmhub Vice President Jenny Herald.

By Elizabeth Flood • Aug. 29, 2022 -

SEC boosts incentives for whistleblowers

The SEC awarded a record $564 million to 108 whistleblowers last year and receives dozens of tips of wrongdoing each day.

By Jim Tyson • Aug. 29, 2022 -

PCAOB, Chinese authorities reach deal as delisting threat looms

SEC Chair Gary Gensler cautioned that foreign issuers that want access to U.S. public capital markets must be on a level playing field with U.S. firms.

By Maura Webber Sadovi • Aug. 26, 2022 -

SEC adopts pay-versus-performance disclosure rules

The rule, revived from a 2015 proposal, requires companies to include a table tracking both executive compensation and financial performance indicators for a five-year period.

By Grace Noto • Aug. 26, 2022 -

Fitch sees ‘modest’ tax headwind from Inflation Reduction Act

Fitch’s assessment comes as CFOs, accountants and tax-preparers are just beginning to grapple with the Inflation Reduction Act’s tax implications.

By Maura Webber Sadovi • Aug. 24, 2022 -

M&A sparked by ESG surges 111% in H1 2022

Pressure for sustainability disclosure is fueling dealmaking targeted at providers of ESG software and services, Hampleton Partners said.

By Jim Tyson • Aug. 24, 2022 -

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Twitter whistleblower claims may bolster federal privacy push

Bipartisan efforts to protect consumer information may gain momentum following allegations that Twitter failed to safeguard private data.

By Jim Tyson • Aug. 23, 2022 -

FASB calls for comments on tax credit change

The move marks another step toward simplifying accounting rules related to Renewable Energy Tax Credits and several other credit programs.

By Maura Webber Sadovi • Aug. 22, 2022 -

CFOs-turned-CEOs have ‘worse outcome’

CFOs turned CEOs must “let go” of finance so they can become stronger in other areas like investments and innovation, experts say.

By Elizabeth Flood • Aug. 18, 2022 -

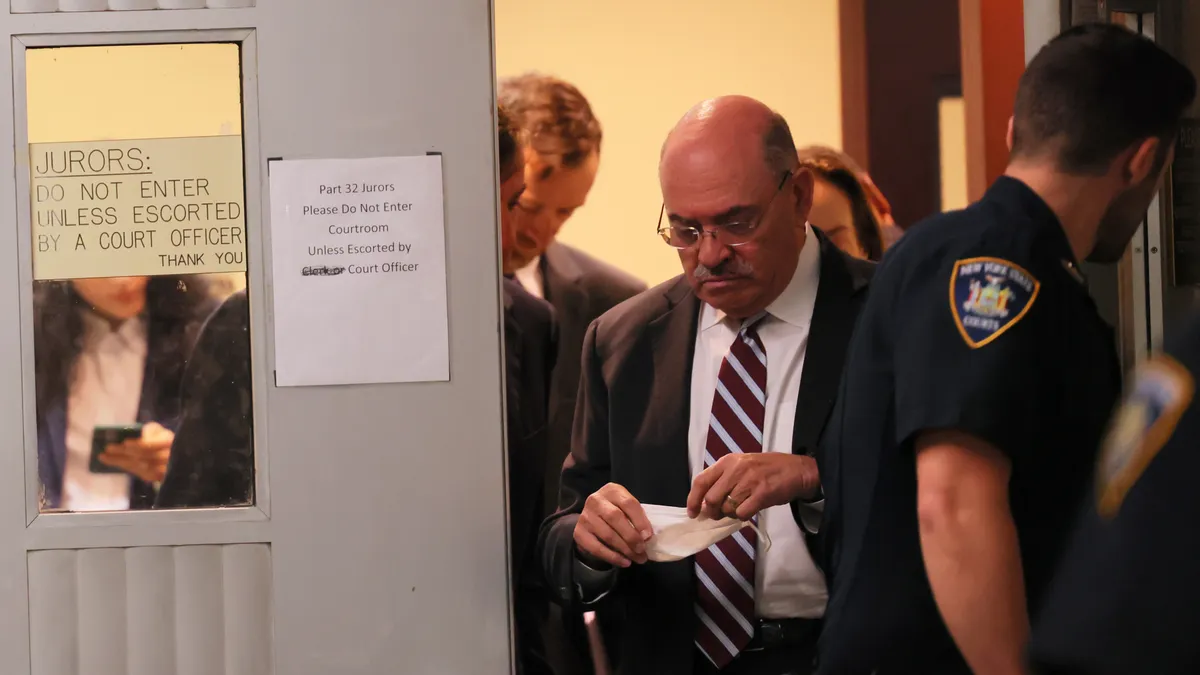

Former Trump CFO pleads guilty in tax scheme

At the core of the charges that Trump Organization executive Allen Weisselberg pleaded guilty to Thursday is a scheme to evade income taxes by hiding compensation.

By Maura Webber Sadovi • Aug. 18, 2022 -

SEC backs tougher rules for audits involving multiple firms

SEC Chair Gary Gensler hailed efforts to avert significant errors in audits by multiple firms, including mistakes in the calculation of revenue and measurement of fair value.

By Jim Tyson • Aug. 16, 2022 -

AICPA warning on 15% tax timeline goes unheeded

CFOs at companies on the threshold of being subject to the new tax will also need to familiarize themselves with the complex rules.

By Maura Webber Sadovi • Aug. 15, 2022 -

Bankrupt Celsius pulls bid to hire ex-CFO

Cryptocurrency firm Celsius pulls motion to tap its former CFO as a bankruptcy advisor following legal objections filed from investors.

By Grace Noto • Aug. 8, 2022