Risk Management: Page 49

-

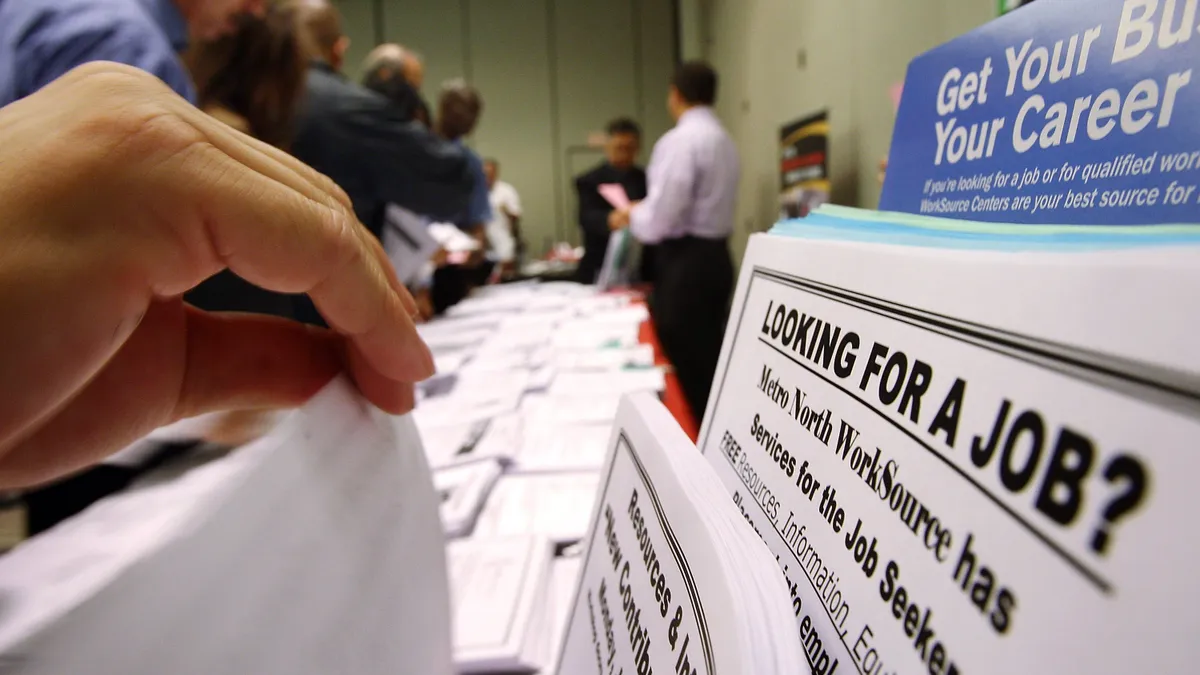

30% of CFOs see economic downturn triggering layoffs: study

CFOs expect potential layoffs, workforce retention challenges and move to implement cost-cutting measures as an economic downturn becomes more likely.

By Grace Noto • Sept. 15, 2022 -

Producer prices show inflation spreading

Rising costs for transportation and other services suggest that inflation is gaining strength across the economy.

By Jim Tyson • Sept. 14, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineNavigating risk in turbulent times

CFOs must help their organizations mitigate risks by balancing the need for both growth and stability.

By CFO Dive staff -

High inflation persists, bolstering case for forceful Fed tightening

Price gains during August for rent and other services exceeded forecasts, eroding hopes that the Federal Reserve will slow its campaign to curb demand.

By Jim Tyson • Sept. 13, 2022 -

Recession likely in 2023, Fitch says

Cuts to estimates for earnings growth underscore the growing risk of a U.S. downturn next year, Fitch Ratings said.

By Jim Tyson • Sept. 12, 2022 -

ESG ratings firms show ‘significant shortcomings’: study

ESG ratings providers, while gaining from rising demand for their assessments, are unreliable in gauging risk and return, Stanford University researchers said.

By Jim Tyson • Sept. 9, 2022 -

Bankruptcies fall during first half of 2022 yet risks loom

Factors such as rising borrowing costs may fuel a rise in bankruptcy filings after a decline during the first half of 2022, Cornerstone Research said.

By Jim Tyson • Sept. 7, 2022 -

Q3 earnings estimates cut ‘more than average’: FactSet

S&P 500 companies for the second quarter reported their lowest growth in earnings on an annual basis since the fourth quarter of 2020, FactSet said.

By Jim Tyson • Sept. 6, 2022 -

PCAOB finds audit flaws on fraud risk, SPACs

During the coming inspection period, the PCAOB’s so-called Target Team will focus on “risks related to climate change” that influence companies’ financial statements.

By Jim Tyson • Sept. 2, 2022 -

SEC pay-vs-performance rule called a chance to shape company story

The disclosures give executives a chance to put into perspective the strategy they’re following to increase long-term shareholder value.

By Robert Freedman • Sept. 1, 2022 -

Workers gain clout during pandemic: Gallup

CFOs face pressure to raise wages as the number of job vacancies far exceeds the number of unemployed people looking for work.

By Jim Tyson • Aug. 31, 2022 -

Fed’s Williams sees inflation falling to 2.5% to 3% next year

The Federal Reserve must interpret several “crosscurrents” in the economy as it fulfills its pledge to curb inflation to 2%, according to the president of the New York Fed.

By Jim Tyson • Aug. 30, 2022 -

CFOs more worried about inflation than recession: Deloitte

Nearly three quarters of CFOs are more concerned about persistent inflation than a recession, Deloitte’s third-quarter survey found.

By Elizabeth Flood • Aug. 30, 2022 -

SEC boosts incentives for whistleblowers

The SEC awarded a record $564 million to 108 whistleblowers last year and receives dozens of tips of wrongdoing each day.

By Jim Tyson • Aug. 29, 2022 -

Six CFO tips for defanging inflation: Deloitte

While most CFOs have never faced the high price pressures of today, they can take steps to blunt the harm to their companies from inflation, Deloitte said.

By Jim Tyson • Aug. 26, 2022 -

U.S. companies face ‘growing risk’ to profit margins: Fitch

Many CFOs during the second quarter were apparently able to pass on to consumers the rising cost of labor and materials. That may not last, Fitch Ratings said.

By Jim Tyson • Aug. 25, 2022 -

M&A sparked by ESG surges 111% in H1 2022

Pressure for sustainability disclosure is fueling dealmaking targeted at providers of ESG software and services, Hampleton Partners said.

By Jim Tyson • Aug. 24, 2022 -

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Twitter whistleblower claims may bolster federal privacy push

Bipartisan efforts to protect consumer information may gain momentum following allegations that Twitter failed to safeguard private data.

By Jim Tyson • Aug. 23, 2022 -

Earnings Roundup: Big oil CFOs brace for inflation, eye demand

Exxon and Chevron finance chiefs signaled on second quarter earnings calls that they are closely tracking demand as recession worries loom.

By Grace Noto • Aug. 23, 2022 -

Fed unlikely to avoid recession: economists

Almost 50% of economists believe a downturn will begin by the first quarter of 2023, the National Association for Business Economics found in a survey.

By Jim Tyson • Aug. 22, 2022 -

Supply chains unclogging, slowing inflation: report

With coronavirus disruptions waning, goods are flowing more smoothly across the economy, reducing price pressures, RSM said.

By Jim Tyson • Aug. 19, 2022 -

U.S. may fall into recession by early 2023: Conference Board

Factors including stock market volatility and a slump in both housing construction and manufacturing orders could cause a downturn by early next year.

By Jim Tyson • Aug. 18, 2022 -

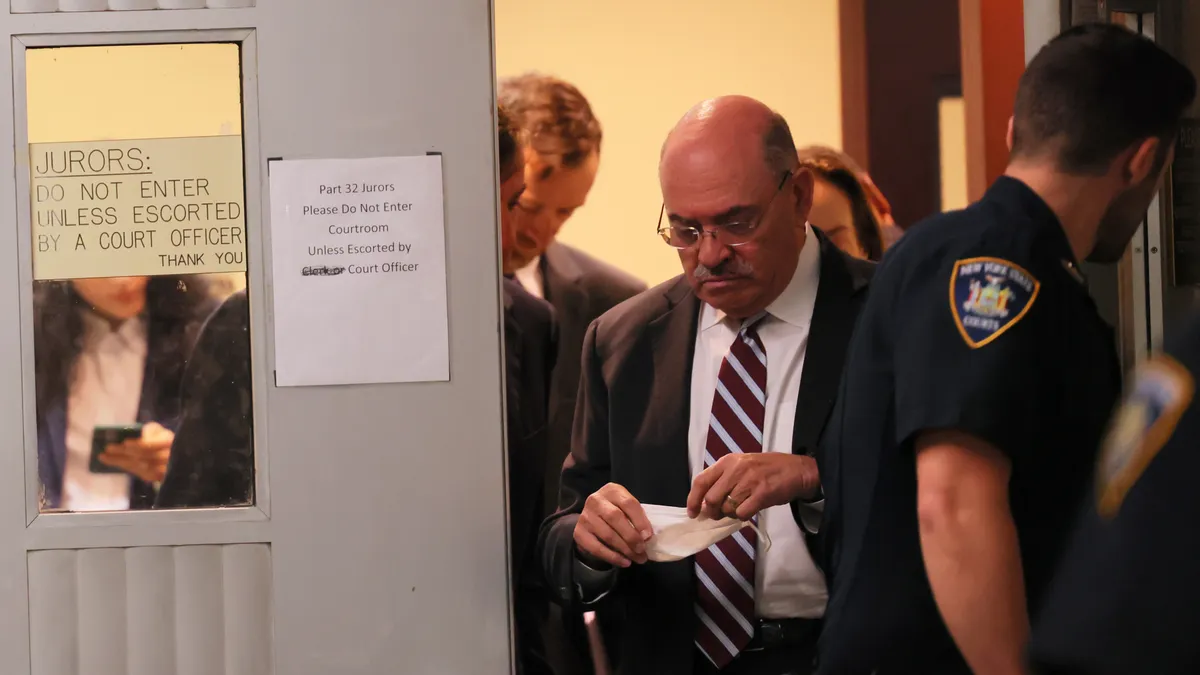

Former Trump CFO pleads guilty in tax scheme

At the core of the charges that Trump Organization executive Allen Weisselberg pleaded guilty to Thursday is a scheme to evade income taxes by hiding compensation.

By Maura Webber Sadovi • Aug. 18, 2022 -

Fed planned more tightening while noting risk of going too far

Central bank officials last month gave no indication of plans to slow their fight against inflation while noting an imperative to alter policy based on fresh economic data.

By Jim Tyson • Aug. 17, 2022 -

SEC backs tougher rules for audits involving multiple firms

SEC Chair Gary Gensler hailed efforts to avert significant errors in audits by multiple firms, including mistakes in the calculation of revenue and measurement of fair value.

By Jim Tyson • Aug. 16, 2022 -

Consumer sentiment rises on improved inflation expectations

The falling price of energy and other essential goods buoyed consumer sentiments, the University of Michigan found in a survey this month.

By Jim Tyson • Aug. 15, 2022