Strategy & Operations: Page 35

-

Global M&A rises above ongoing headwinds

The findings show “some light at the end of the tunnel” after a challenging year for M&A globally in 2023, according to Willis Towers Watson’s David Dean.

By Alexei Alexis • April 3, 2024 -

Return-to-office delays burden regional bank real estate portfolios

“There's been a Frankenstein from the pandemic that's been created, and we don't know how to stop it,” TD Bank’s Gregory Carlisle said last week.

By Suman Bhattacharyya • April 2, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital transformation, one smart step at a time

As pricing pressures tighten margins and technologies like agentic AI evolve, finance chiefs are more closely scrutinizing the cost and returns of the tech tools they implement.

By CFO Dive staff -

5 tips from CFOs on how to win the CFO seat: McKinsey

Executives aiming to rise to the CFO seat have faced a bright landscape in recent years, with turnover unusually high.

By Jim Tyson • April 2, 2024 -

Opinion

Fixing the broken state of SaaS purchasing

A “growth-at-all-costs” mentality has led some SaaS companies to overpromise results and obscure pricing details, writes Olive Technologies CEO Chris Heard.

By Chris Heard • April 2, 2024 -

IPO market strengthens as economy defies recession forecasts: EY

Investor enthusiasm for artificial intelligence may spur companies to go public in coming months, EY said.

By Jim Tyson • April 1, 2024 -

Inflation ‘bursts’ may exceed Fed’s 2% target due to public debt: Brookings

Policymakers face several inflationary forces, including rising spending on defense and aging populations, economists said in a Brookings paper.

By Jim Tyson • March 29, 2024 -

CFOs trim hiring while adopting automation: Fed survey

The rising use of robots, artificial intelligence and other automation aligns with signs in recent months that the labor market is cooling.

By Jim Tyson • March 28, 2024 -

Startup looking to disrupt ERP market with AI raises $9.2M

New York-based Nominal said its funding round included participation from executives at Salesforce, ServiceNow and Intel.

By Alexei Alexis • March 28, 2024 -

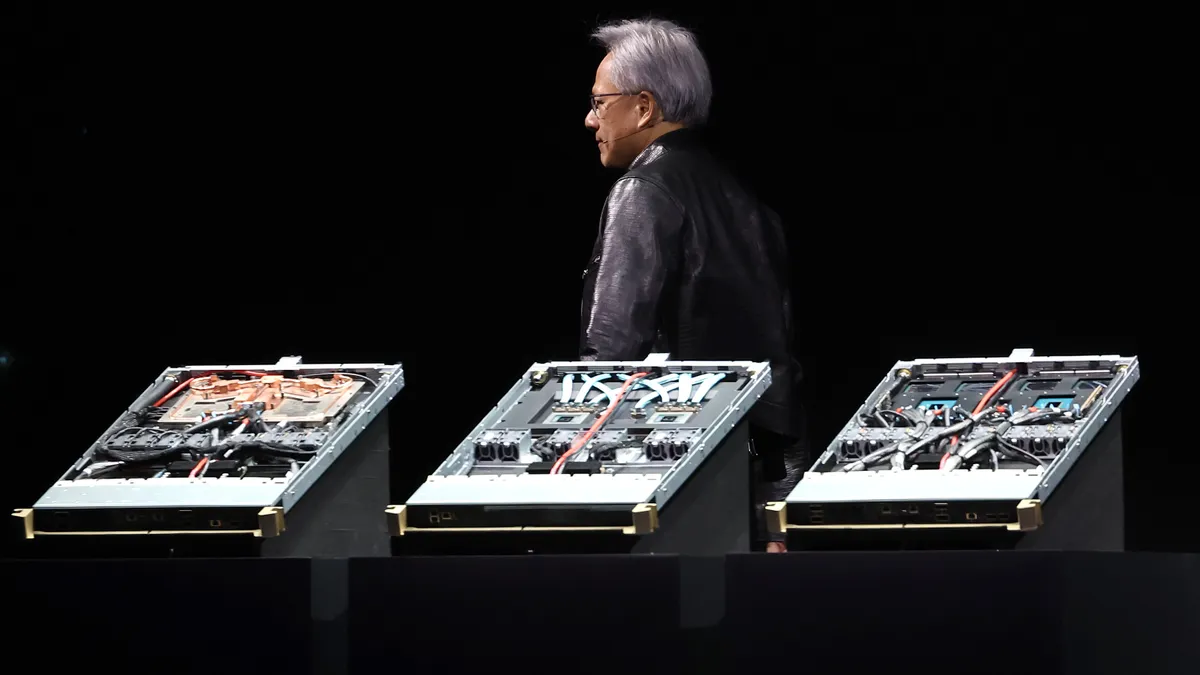

Chip costs weigh on AI ROI

AI-driven efficiency gains will likely propel ongoing investments. The cost implications for CFOs are just coming to light.

By Suman Bhattacharyya • March 28, 2024 -

Ford CFO: Bridge collapse will likely ‘lengthen’ supply chain

The automaker will have to divert parts to other ports along the East Coast or elsewhere in the U.S., Ford’s finance chief said Tuesday.

By Maura Webber Sadovi • March 27, 2024 -

Interim ADM CFO gets $35K monthly pay boost

Embattled Archer Daniels Midland also gave interim finance chief Ismael Roig restricted stock valued at $1 million that will fully vest in March of next year.

By Maura Webber Sadovi • March 26, 2024 -

Zoom launches AI collaboration hub, brings automation to the fore

Zoom One bundles will rebrand to Zoom Workplace bundles for new and existing customers following a public release in April and May.

By Lindsey Wilkinson • March 26, 2024 -

AI scales up fraud controls, but humans still vital

AI analytics technology is turbocharging anti-fraud measures through its ability to process oceans of financial data.

By Chris Gaetano • March 26, 2024 -

Tax-free M&A comes in crosshairs of bipartisan Senate legislation

An effort to scuttle deal-making tax exemptions coincides with signs of life in M&A after a severe slump last year.

By Jim Tyson • March 25, 2024 -

Office real estate value likely to plunge 26% through 2025: Moody’s

An above-average amount of commercial real estate debt will soon mature and property owners will need to refinance at the highest rates in years, Moody’s said.

By Jim Tyson • March 22, 2024 -

Companies plan 4.5% pay raises this year, outpacing inflation: Payscale

As price pressures fall, pay increases will help employees recover from the highest inflation in four decades, Payscale said.

By Jim Tyson • March 21, 2024 -

Marqeta CFO touts EWA expansion

The card-issuing fintech has seen adoption of its debit card-linked EWA product increase as hourly workers at Walmart and Uber have been added, CFO Mike Milotich said.

By James Pothen • March 21, 2024 -

Boeing to spend $4B plus to fix safety, supply chain woes: CFO

The aerospace company’s finance chief on Wednesday detailed some of the financial implications of the safety issues that have have recently plagued the company.

By Suman Bhattacharyya • March 20, 2024 -

Fed forecasts three, quarter-point rate cuts in 2024, holds main rate steady

Central bank officials upgraded their projection for 2024 economic growth to 2.1% while predicting unemployment will end the year at 4%.

By Jim Tyson • March 20, 2024 -

Tech Q1 job cuts surge above 50K

The latest figures show that layoff activity in the tech sector may be far from over despite a huge drop after the first quarter of last year.

By Alexei Alexis • March 19, 2024 -

CFOs play it safe on AI spending

Close to two-thirds (62%) of CFOs responding to a Deloitte poll anticipated an allocation of less than 1% of their organization’s budget for GenAI next year.

By Alexei Alexis • March 19, 2024 -

Audit committees rank cybersecurity as top priority amid SEC crackdown

Cyberattacks are just one of several rapidly changing threats confronting audit committees, according to the Center for Audit Quality and Deloitte.

By Jim Tyson • March 14, 2024 -

Affirm CFO swears off auto lending, for now

The buy now, pay later company seeks to be involved in more consumer spending opportunities, but finance chief Michael Linford all but ruled out auto lending.

By Caitlin Mullen • March 13, 2024 -

Inflation exceeds forecasts, affirming Fed’s caution on initial rate cut

Futures trading suggested that the odds that policymakers will cut the main interest rate by at least a quarter point on May 1 have plunged to 11% from 52% a month ago.

By Jim Tyson • March 12, 2024 -

Peloton CFO leans on cost cutting to reverse post-pandemic slump

Finance chief Liz Coddington is cutting overhead costs and driving more revenue from Peloton’s digital subscription and bike rental businesses.

By Suman Bhattacharyya • March 12, 2024