Strategy & Operations: Page 41

-

Johnson & Johnson CFO: Pandemic lesson drove $40B deal’s fast pace

COVID-19 taught J&J’s finance chief the value of “speed and agility” in business, Joseph Wolk said at the MIT Sloan CFO Summit.

By Maura Webber Sadovi • Nov. 16, 2023 -

Retail sales fall, adding to signs economy cooling after hot Q3 growth

Gradual declines in consumer spending, hiring and inflation suggest that the Federal Reserve may achieve a “soft landing” for the economy.

By Jim Tyson • Nov. 15, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital transformation, one smart step at a time

As pricing pressures tighten margins and technologies like agentic AI evolve, finance chiefs are more closely scrutinizing the cost and returns of the tech tools they implement.

By CFO Dive staff -

Lowe’s veteran tapped for Advance Auto CFO seat

The appointment comes as the auto parts supplier is focused on a comprehensive review of the business after posting weak financial results this year.

By Alexei Alexis • Nov. 15, 2023 -

Inflation slows, spurring bets Fed will start cutting rates in May

Price pressures declined last month in all major categories except for food, the Labor Department reported.

By Jim Tyson • Nov. 14, 2023 -

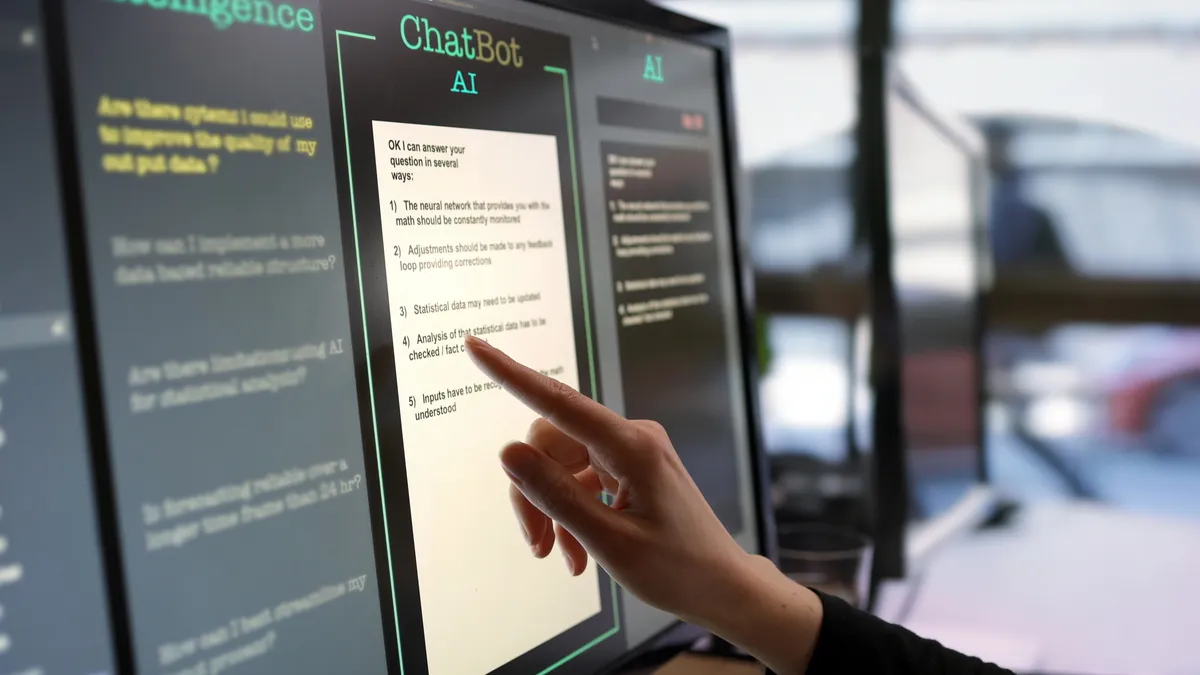

Finance teams lag behind HR, legal in AI adoption: Gartner

“CFOs want to be sure they can trust the technology, and part of that trust is understanding how it works and where it fits” within the finance function, Gartner’s Marco Steecker said.

By Alexei Alexis • Nov. 14, 2023 -

Escalating SaaS prices outpace CPI inflation

Software-as-a-service spending now accounts for 14.1% of a typical company’s expense line, up from 12.7% last year, according to research from Vertice.

By Alexei Alexis • Nov. 14, 2023 -

Fed whipsawed on key signals for inflation expectations

With just a month before their next meeting, Fed officials are tracking expectations for inflation as a sign of whether businesses will raise prices and workers will demand higher pay.

By Jim Tyson • Nov. 13, 2023 -

Sponsored by TravelBank

4 ways streamlining T&E can speed up the month-end financial close process

To speed up expense reconciliation — and, in turn, the financial close — companies need to ditch manual processes and embrace solutions that make managing travel and expenses faster and easier.

Nov. 13, 2023 -

Opinion

Why CFOs must remove barriers to growth in a ‘deadweight’ economy

What sets apart leading efficient-growth companies is the way they remove barriers or “growth anchors” that impede action, Gartner’s Dennis Gannon writes.

By Dennis Gannon • Nov. 10, 2023 -

Powell says Fed’s inflation fight ‘has a long way to go’

The Fed needs to see more signs of easing price pressures before declaring an end to monetary tightening, central bank officials said.

By Jim Tyson • Nov. 9, 2023 -

PCAOB chief chides auditors for blaming failures on talent shortage

The quality of audits has trended “in the wrong direction for the second year in a row,” PCAOB Chair Erica Williams said.

By Jim Tyson • Nov. 8, 2023 -

Half of cloud transformations are ‘abject failures’

As the technology matures, CFOs are asking CIOs to justify the business value of existing migrations, HFS CEO and Chief Analyst Phil Fersht said.

By Matt Ashare • Nov. 8, 2023 -

SEC commissioner suggests ‘re-proposing’ climate risk disclosure rule

Some investors seek broader company disclosures with the aim of promoting social change rather than clarifying stock valuations, SEC Commissioner Mark Uyeda said.

By Jim Tyson • Nov. 7, 2023 -

Banks tighten standards on loans to companies of all sizes: Fed

Demand for commercial and industrial loans fell during the third quarter as the Fed pushed up the benchmark interest rate to a 22-year high.

By Jim Tyson • Nov. 6, 2023 -

Truist pushes ambitious reorganization in $750M cost-cutting plan

CFO Mike Maguire says the bank is making good progress, as it grapples with a string of high-profile executive departures.

By Suman Bhattacharyya • Nov. 6, 2023 -

shutterstock.com/Deemerwha studio

Sponsored by Paro

Sponsored by ParoA data governance blueprint for finance teams

Learn how CFOs can establish controls and cross-departmental partnerships for stronger data governance.

Nov. 6, 2023 -

NJ ranks worst in business taxes with NY close behind

The Garden State may rise from dead last in corporate tax rankings if a 2.5% business tax surcharge expires at the end of this year as scheduled, the Tax Foundation said.

By Jim Tyson • Nov. 2, 2023 -

PayPal CEO pledges ‘leaner’ business, names new CFO

Alex Chriss, who took the top post in September, tapped a new finance chief Wednesday and pledged to better focus the digital payment company's strategy.

By Lynne Marek • Nov. 2, 2023 -

Fed holds main rate steady, flags option of future hike

The central bank kept the federal funds rate unchanged despite higher-than-forecast strength in hiring and economic growth.

By Jim Tyson • Nov. 1, 2023 -

Companies relying on foreign sales see Q3 earnings slump 4.7%

The dollar rose against other major currencies during the third quarter, eroding revenues at large companies such as Pfizer and Exxon Mobil, FactSet said.

By Jim Tyson • Oct. 31, 2023 -

Small businesses imperiled by credit crunch: Goldman

Federal Reserve officials begin meeting Tuesday to assess several crosscurrents in the economy as companies adjust to the highest borrowing costs in 22 years.

By Jim Tyson • Oct. 30, 2023 -

McDonald’s CFO: Traffic dips despite ‘trade down’ gains

The dip comes as Chicago-based McDonald’s has battled to offset rising costs by raising prices without alienating customers.

By Maura Webber Sadovi • Oct. 30, 2023 -

Sponsored by Bellus Ventures

The changing face of clean energy and tax strategy

The Inflation Reduction Act has changed the tax landscape. CFO Dive spoke with Bellus Ventures and Thompson Coburn LLP to understand the steps that CFOs can take to stay ahead of the curve on clean energy investments.

Oct. 30, 2023 -

Sponsored by Mercer

Weighing the benefits: Why more employers are transferring DB risk

Moving away from defined benefit plans as the primary retirement program doesn’t require terminating the plan outright.

Oct. 30, 2023 -

Consumers, inflation give hopeful Halloween retailers a dose of the scaries

Total Halloween spending is forecast to hit $12.2 billion this year, but rising wage and sugar costs are cutting into profits.

By Chris Gaetano • Oct. 27, 2023