Treasury

-

Consumers without stock holdings harbor ‘dismal’ outlook: survey

Results from a University of Michigan survey line up with a post-pandemic income trend — wealthy consumers are thriving while many other households are struggling.

By Jim Tyson • Feb. 6, 2026 -

Job openings plunge to lowest level in more than five years: BLS

Two government reports bolstered recent private sector data that have flagged job market weakness.

By Jim Tyson • Feb. 5, 2026 -

Service industry grows at fastest pace since Oct. 2024, ISM says

Growth in services aligns with the ISM’s purchasing managers index of manufacturing activity, which last month increased to the highest level since August 2022.

By Jim Tyson • Feb. 4, 2026 -

Missouri may ditch income tax. Will it hurt or help business?

The Show Me State is the latest to consider eliminating state taxes on income, but the plan to replace that revenue could harm some businesses, tax specialists say.

By Stephen Joyce • Feb. 3, 2026 -

Deep Dive

4 CFO tips for thriving despite volatile dollar, end of ‘Pax Americana’

The dollar, battered by disruption to the rules-based global order, stands at center stage in an unfolding drama of market volatility.

By Jim Tyson • Feb. 3, 2026 -

Cash deposit safety still tops CFO worries, survey finds

Despite calls to close risk gaps after Silicon Valley Bank’s failure, many businesses still wouldn’t be able to operate for over three months without access to their primary bank, Ampersand says.

By Maura Webber Sadovi • Feb. 2, 2026 -

Fed holds main rate steady, highlighting signs of job market stability

Two Federal Reserve governors dissented against the decision to leave policy unchanged, favoring a fourth consecutive cut to borrowing costs.

By Jim Tyson • Updated Jan. 28, 2026 -

CFO Dive’s 2026 outlook roundup: Trends to watch

Financial executives in the new year must prepare for potential changes to several building blocks at the foundation of corporate strategy.

By Jim Tyson • Jan. 28, 2026 -

Fed’s preferred inflation gauge falling below policymakers’ forecast

The central bank will probably leave the federal funds rate unchanged after a two-day meeting ending on Jan. 28, according to the CME Group’s FedWatch tool.

By Jim Tyson • Jan. 22, 2026 -

US bears 96% of tariff costs, belying Trump’s claims: Kiel Institute

President Donald Trump plans talks with European leaders in Davos, Switzerland, over his threat to impose a 10% tariffs on the exports of NATO members if Denmark does not sell Greenland to the U.S.

By Jim Tyson • Jan. 20, 2026 -

OECD deal should ease global tax compliance, but not immediately

U.S. companies will still likely have to complete all Pillar 2 calculations for this year despite the exemptions, KPMG principal Marcus Heyland said.

By Stephen Joyce • Jan. 16, 2026 -

IRS budget, staff cuts may perpetuate nearly $700B in lost tax revenues

The IRS this year will probably face severe challenges in tax collection because of sweeping changes under the Trump administration, according to groups that track the agency.

By Jim Tyson • Jan. 15, 2026 -

Retail sales rose 0.6% in November despite weak consumer sentiment

The outlook among consumers, though brighter than in September, is still gloomier than in early 2025, according to recent surveys.

By Jim Tyson • Jan. 14, 2026 -

Inflation holds steady, affirming Fed focus on weak job market

“Risks to employment have increased as the labor market cooled, while the upside risks to inflation have lessened somewhat,” Federal Reserve Bank of New York President John Williams said.

By Jim Tyson • Jan. 13, 2026 -

Opinion

Why CFOs should watch tokenized securities in 2026

Nasdaq’s push into tokenized securities points to a shift that could soon hit corporate treasury, writes blockchain executive Artem Tolkachev.

By Artem Tolkachev • Jan. 13, 2026 -

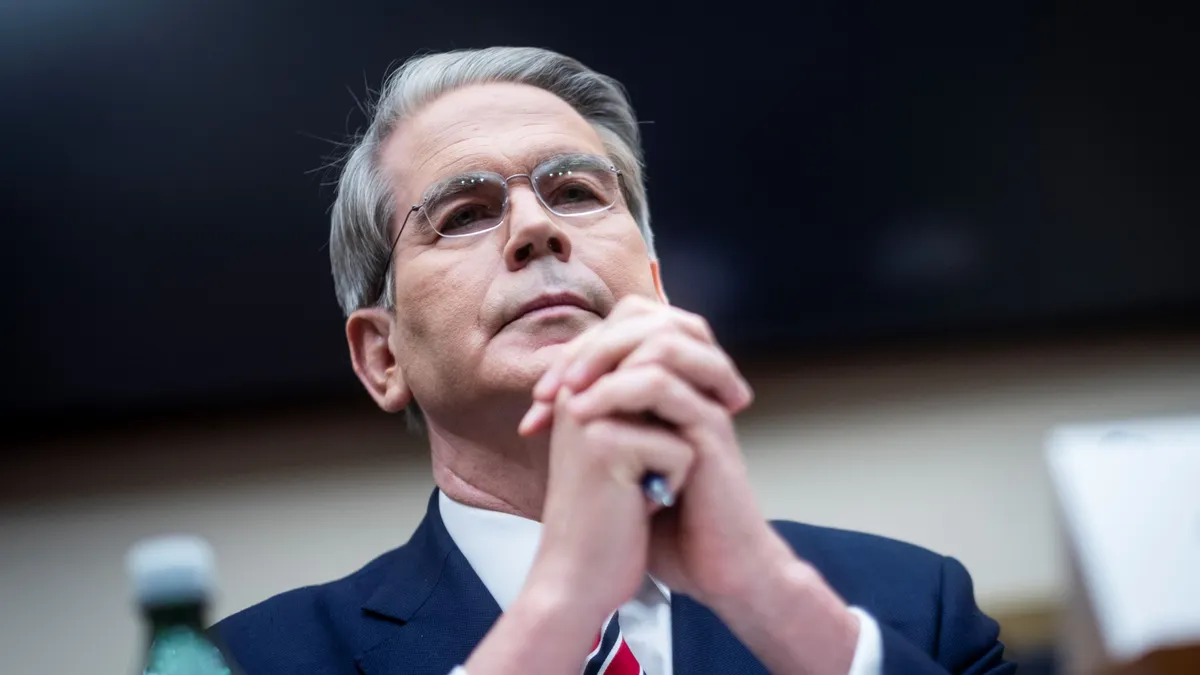

DOJ probe of Powell triggers bipartisan fire against Trump administration

Powell said the motive behind the investigation “should be seen in the broader context of the administration’s threats and ongoing pressure.”

By Jim Tyson • Jan. 12, 2026 -

Hiring declines as employers take cautious view of new year

Following release of employment data, traders in interest rate futures raised the odds that the Fed will leave the main rate unchanged at a meeting late this month.

By Jim Tyson , Alexei Alexis • Jan. 9, 2026 -

Deep Dive

‘Strategic openings’: 5 CFO trends for 2026

Financial executives in the new year must keep a competitive edge by adapting to trends including fluctuating tariff rates and refocusing of priorities at the Securities and Exchange Commission.

By Jim Tyson • Jan. 7, 2026 -

FASB tax rule draws fresh heat in first annual reporting cycle

Under Accounting Standards Update 2023-09, companies must detail much more information on the income taxes they pay than was previously required by GAAP.

By Maura Webber Sadovi • Dec. 19, 2025 -

Consumer sentiment inches up despite anxiety over jobs, inflation

Recent data have likely done little to ease consumer worries, with the unemployment rate rising last month to 4.6%, the highest level in four years.

By Jim Tyson • Dec. 19, 2025 -

Inflation unexpectedly falls to 2.7% after shutdown crimped measurement

Given concerns about potentially distorted inflation data, futures traders only increased by 2 percentage points the probability of a monetary policy easing next month.

By Jim Tyson • Dec. 18, 2025 -

Treasury projects 3.2% rise in business tax preparation costs

U.S. businesses will likely face $131.8 billion in monetized time and compliance costs completing their taxes in fiscal 2026, according to the Treasury Department.

By Stephen Joyce • Dec. 17, 2025 -

Unemployment rises to 4.6%, highest level in more than four years

The rising jobless rate bolsters the Dec. 10 Federal Reserve decision to firm up the labor market by trimming the main interest rate by a quarter point.

By Jim Tyson • Dec. 16, 2025 -

CEO confidence rises amid planning to reduce employment

Among surveyed CEOs, 31% identified labor costs as the biggest force behind inflation, the Business Roundtable said.

By Jim Tyson • Dec. 12, 2025 -

Costco suit sparks tariff refund FOMO, but it’s not the only relief route

Firms mulling similar litigation should “do their homework” and check deadlines for alternative and potentially less costly actions, trade attorney Doreen M. Edelman said.

By Maura Webber Sadovi • Dec. 10, 2025