Risk Management: Page 47

-

New Zip file phishing trend threatens cybersecurity

Organizations are at an increased risk of cyber attacks with this new popular phishing technique that does not require a password.

By Elizabeth Flood • Oct. 31, 2022 -

Rising wages, inflation keep Fed on track for Nov. 2 tightening

CFOs may not realistically expect wage pressures to ease as long as pay increases lag inflation and job openings exceed the number of job seekers.

By Jim Tyson • Oct. 28, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineNavigating risk in turbulent times

CFOs must help their organizations mitigate risks by balancing the need for both growth and stability.

By CFO Dive staff -

ESG goals versus action gap emerges: survey

One in five financial leaders do not currently consider any ESG information when making decisions and instead rely on traditional financial metrics, the survey found.

By Grace Noto • Oct. 28, 2022 -

Crypto regulation to win more investors: FTX US advisor

The "decade of free money" is ending, but crypto will bounce back with the overall market, according to Brett Harrison.

By Gabrielle Saulsbery • Oct. 27, 2022 -

Ukraine raises fresh fraud concerns, Stripe exec says

The war in Ukraine raised the stakes for fraud detection, as threat actors devise more complex ways of evading oversight.

By Suman Bhattacharyya • Oct. 26, 2022 -

SEC adopts bonus clawback rules

The new clawback rules come amid a broader push by the SEC for more transparency and disclosures in financial reports.

By Maura Webber Sadovi • Oct. 26, 2022 -

Low-tax laurels go to Wyoming, NJ dead last

Companies are more likely to move to another state with lower taxes than to an appealing foreign location, the Tax Foundation said.

By Jim Tyson • Oct. 26, 2022 -

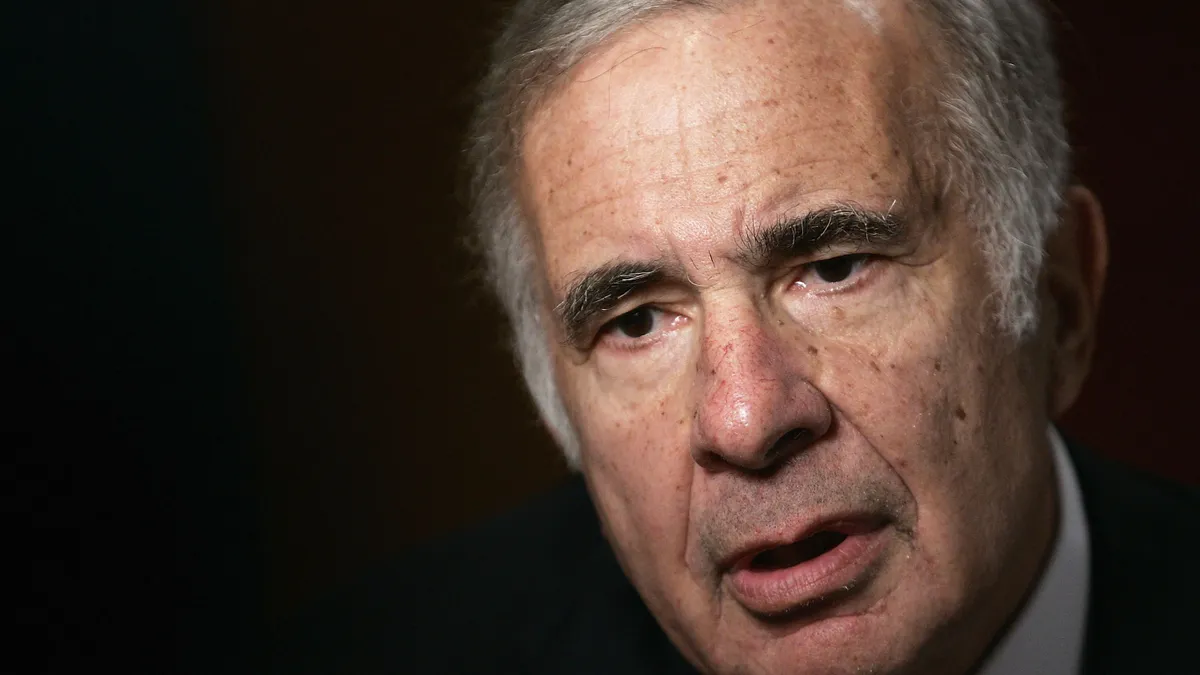

Judge denies Rialto bid to dismiss Icahn mall suit

The suit comes as CFOs are likely to face more disputes around appraisals as the slowing economy impacts real estate valuations.

By Maura Webber Sadovi • Oct. 25, 2022 -

Rising rates slow home price gains

Spiking mortgage rates are discouraging home buyers and slowing price gains in the housing market, a key economic indicator.

By Grace Noto • Oct. 25, 2022 -

More companies lag Q3 earnings estimates: FactSet

Inflation, surging interest rates, cautious consumers and a rising dollar have eroded profits at many big companies.

By Jim Tyson • Oct. 24, 2022 -

More than half of economists brace for recession: NABE

Rising wages and other cost pressures have dimmed economists’ outlook.

By Grace Noto • Oct. 24, 2022 -

Deep Dive

CFO stressors: Sounding the alarm after suicide

Gustavo Arnal’s death has led to new conversations around C-suite mental healthcare and the rising pressures challenging even the most battle-tested finance leaders.

By Maura Webber Sadovi • Oct. 24, 2022 -

Carol Highsmith. (2005). "Apex Bldg." [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "Apex Bldg." [Photo]. Retrieved from Wikimedia Commons.

FTC redoubles Biden fight against ‘junk fees’

The White House seeks to wipe out hidden charges levied by companies involved in more than two dozen industries.

By Jim Tyson • Oct. 21, 2022 -

Small businesses mull hiring freeze

Many small businesses are pausing hiring or considering a hiring freeze, and most anticipate a recession within the next six months.

By Grace Noto • Oct. 21, 2022 -

Opinion

Tackling the build versus buy forecasting dilemma

The rise in economic volatility is increasing the need for better decisions when it comes to acquiring and interpreting forecasting data.

By John Frechette • Oct. 20, 2022 -

Recession to start in Q2 2023, Fitch says

Warnings of a possible downturn are increasing amid a steady withdrawal of monetary stimulus, a slump in the housing market and a weakening in retail spending.

By Jim Tyson • Oct. 19, 2022 -

PCAOB hits audit partner with record $150K penalty

The fine is the largest civil penalty levied against an individual by the federal audit watchdog since it was established in 2002.

By Maura Webber Sadovi • Oct. 19, 2022 -

Deep Dive

7 CFO tips to prepare for SEC climate risk rule

CFOs should not delay putting in place the staff, technology and processes needed to comply with an imminent SEC rule requiring detailed disclosure on climate risk.

By Jim Tyson • Oct. 18, 2022 -

Deep Dive

ESG backlash unlikely to derail SEC climate risk rule

SEC Chair Gary Gensler faces growing resistance to the agency’s proposal that companies provide detailed disclosures on carbon emissions.

By Jim Tyson • Oct. 17, 2022 -

FASB fair-value play poised to clear crypto barrier

If adopted, the standard would eliminate a deterrent that keeps some companies from getting involved with crypto, according to a Crowe LLP partner.

By Maura Webber Sadovi • Oct. 17, 2022 -

Feds step up focus on companies’ use of dark patterns

The Federal Trade Commission is signaling that it intends to go after the use of online manipulation tactics to separate consumers from their money.

By Robert Freedman • Oct. 14, 2022 -

Crises demand resilience plans from CFOs

CFOs need new ways to prepare for crises, with resilience plans, and the storied Waffle House Index part of a mix of long and short-term tactics coming into focus.

By Suman Bhattacharyya • Oct. 13, 2022 -

FASB votes for fair-value crypto fix

The FASB’s tentative decision Wednesday is an important step toward providing an answer to the crypto valuation question companies and other stakeholders have been clamoring for.

By Maura Webber Sadovi • Oct. 13, 2022 -

Layoff upswing doesn’t dampen labor market

The uptick in layoffs and downturn in hiring is still not enough to cool a stubbornly red-hot labor market.

By Grace Noto • Oct. 12, 2022 -

Global hazards outstrip corporate risk preparations

Less than half of respondents rated their companies’ approach to risk-management as “mature” or “robust,” according to the report.

By Maura Webber Sadovi • Oct. 12, 2022