Risk Management: Page 56

-

Risks rise as COVID-19 compels companies to weaken due diligence: Refinitiv

The coronavirus has permanently broadened the risk landscape beyond financial crime, confronting CFOs with challenges that encompass environmental and social concerns.

By Jim Tyson • Nov. 29, 2021 -

Sponsored by EY

How "agile allocators" boost long-term value

High-performing companies are taking an agile and aggressive approach to capital allocation – it often means the difference between excess returns and underperformance.

Nov. 29, 2021 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineNavigating risk in turbulent times

CFOs must help their organizations mitigate risks by balancing the need for both growth and stability.

By CFO Dive staff -

$1.7 trillion U.S. spending bill would not stoke inflation: Moody's

Concerns about the impact of the "social infrastructure" bill on inflation and the U.S. fiscal outlook may be overblown.

By Jim Tyson • Nov. 23, 2021 -

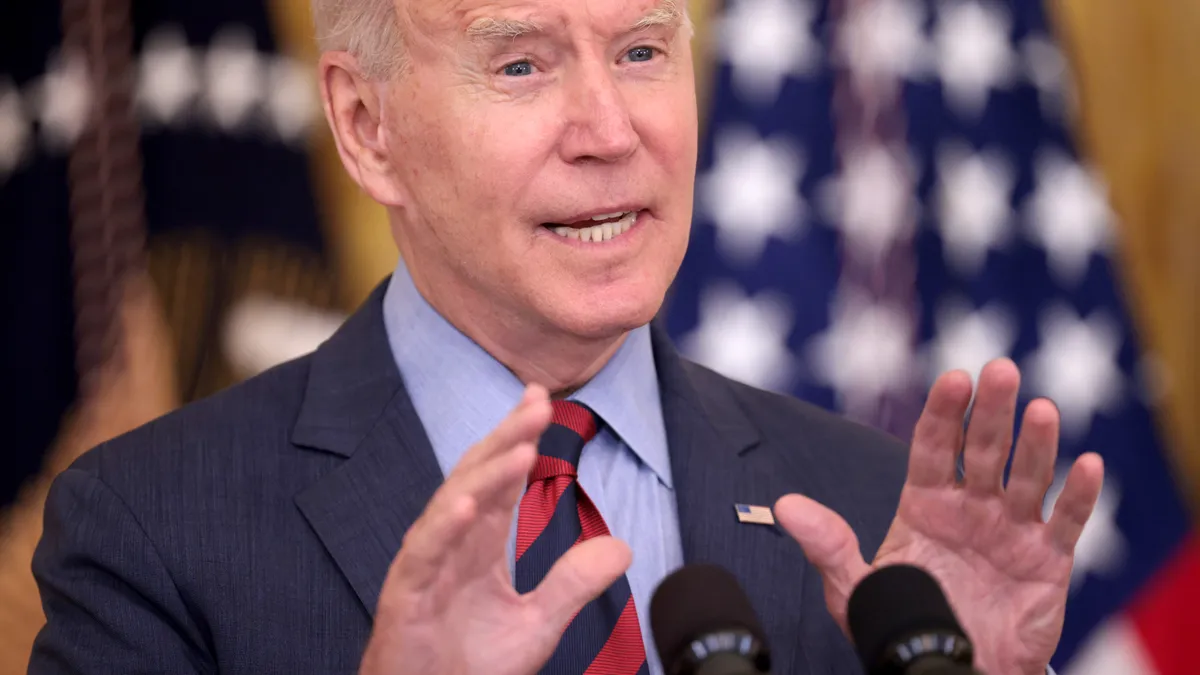

Biden taps Powell for second Fed term, supporting continuity

Biden's emphasis on monetary policy continuity is unlikely to discourage Powell from withdrawing record stimulus if inflation continues to accelerate.

By Jim Tyson , Dan Ennis • Nov. 22, 2021 -

Leveraging your position as an ousted CFO

Terminated CFOs aren't without options if they know where to look for negotiation flexibility, an attorney says.

By Robert Freedman • Nov. 19, 2021 -

With inflation rising, CFOs rethink hedging strategies

Finance leaders need more than treasury at the table when mapping out what derivatives to buy, at what price, and how to account for them, says a specialist.

By Robert Freedman • Nov. 17, 2021 -

6 CFO tips for freeing up cash, fighting inflation: McKinsey

With inflation running at a 30-year high, CFOs can identify dormant cash on their balance sheets and put it to use, McKinsey said.

By Jim Tyson • Nov. 16, 2021 -

CFO strategies for turning the ESG movement into a win-win

CFOs face rising pressure to endorse sustainability best practices. They can find new profit opportunities by embracing ESG benchmarking and other investor priorities.

By Jim Tyson • Nov. 12, 2021 -

Inflation poses 'upside' risks: Fed official

By the end of next year, conditions will likely be set for the Federal Reserve to begin raising the benchmark interest rate, Fed Vice Chair Richard Clarida said.

By Jim Tyson • Nov. 8, 2021 -

Ransomware criminals targeting confidential M&A data, FBI warns

Ransomware attacks hit at least three publicly traded U.S. companies negotiating M&As from March until June 2020, the FBI said. The talks were not publicly known at two of the companies.

By Jim Tyson • Nov. 5, 2021 -

SEC to 'dig deeper' in cybersecurity enforcement

SEC guidance from 2018 has foreshadowed many recent cybersecurity enforcement actions by the agency’s Cyber Unit.

By Jim Tyson • Nov. 4, 2021 -

Global rule maker created for ESG disclosure standards

CFOs aiming to adopt sustainability disclosure standards must currently choose from more than a dozen inconsistent, competing frameworks.

By Jim Tyson • Nov. 3, 2021 -

ESG 'make-or-break' factor for leading investors: PwC

Most investors want companies to demonstrate a commitment to sustainability but would not tolerate a reduction in returns of more than one percentage point, PwC said.

By Jim Tyson • Nov. 1, 2021 -

CFOs responding to inflation by raising prices, earnings calls show

CFOs say during quarterly earnings that they are passing on increased costs to consumers, raising the prospect that inflation will flare higher.

By Jim Tyson • Oct. 29, 2021 -

Companies raise wages as inflation, worker shortages persist

One out of three companies view rising cost pressure as their biggest risk, according to a National Association for Business Economics survey.

By Jim Tyson • Oct. 25, 2021 -

Cyberattacks spurring demand for cyber insurance: Moody's

“This is a critical area that we’re challenged with,” Securities and Exchange Commission Chair Gary Gensler said, describing the agency’s sharper focus on cyber risk.

By Jim Tyson • Oct. 21, 2021 -

Deep Dive

11 CFO tips for riding the rising tide in ESG activism

CFOs eager to steer clear of shareholder activists should publicly embrace sustainability despite flaws in the measurement of best practices.

By Jim Tyson • Oct. 20, 2021 -

'Programmatic' M&A strategy pays off the most: McKinsey

“Carefully choreographing a series of deals around a specific business case or M&A theme” generates the highest return for shareholders at the lowest risk, McKinsey said.

By Jim Tyson • Oct. 18, 2021 -

Sponsored by Trintech

Catching mistakes before they catch you: Why you should apply automation to your risk management strategy

Manual processes do not offer real-time visibility into the close process, so organizations lose valuable insights on existing or potential risk.

Oct. 18, 2021 -

Boards facing regulatory scrutiny intensify focus on ESG

Corporate directors are waking up to the need to weave sustainability best practices into business strategy, surveys show.

By Jim Tyson • Oct. 15, 2021 -

Small business optimism falls amid inflation, labor shortage

Small businesses are responding to a tight labor market with plans to raise compensation during the next three months, the National Federation of Independent Business said.

By Jim Tyson • Oct. 13, 2021 -

Half of CFOs plan to assess digital currencies for business: Gartner

“Sentiment towards digital currencies appears to be improving among finance leaders,” a Gartner researcher said.

By Jim Tyson • Oct. 12, 2021 -

15% minimum global corporate tax faces obstacles: Tax Foundation

The Treasury pushed hard to gain approval from other countries for a 15% minimum global corporate tax, yet passage by Congress is far from guaranteed.

By Jim Tyson • Oct. 11, 2021 -

U.S. 'AAA' rating may face pressure from debt limit brinkmanship: Fitch

The partisan impasse over raising the debt ceiling showed no signs of easing on Monday as Fitch Ratings warned of pressure on the U.S. credit rating.

By Jim Tyson • Oct. 4, 2021 -

Labor shortages may prolong inflation

The Federal Reserve may underestimate the impact of widespread labor shortages on inflation, central bankers say.

By Jim Tyson • Sept. 29, 2021