Risk Management: Page 63

-

CBO: US federal debt to surge this decade, fueled by rising deficits

Annual federal deficits will rise to 5.7% of GDP by 2031, increasing U.S. debt to a record 107% of GDP that year, according to CBO projections.

By Jim Tyson • Feb. 16, 2021 -

Deep Dive

3 CFO mistakes to avoid as IT spend rises to record in 2021

Financial executives should avert mistakes in digital transformation as they budget record capital for IT purchases this year.

By Jim Tyson • Feb. 15, 2021 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineNavigating risk in turbulent times

CFOs must help their organizations mitigate risks by balancing the need for both growth and stability.

By CFO Dive staff -

Survey: CFOs plan to shore up reserves against pandemic, other risks

CFOs are reacting to the pandemic-induced downturn by reshaping risk strategies and cushioning against future shocks, a Euler Hermes survey finds.

By Jim Tyson • Feb. 9, 2021 -

Study: Companies pivoted during Q3, boosting production even as pandemic spread

After the initial blow from the coronavirus, companies reallocated resources and revived production during the third quarter of 2020.

By Jim Tyson • Feb. 3, 2021 -

SEC appoints policy advisor to advance new initiatives on ESG

The appointment of an ESG advisor by the acting SEC chair follows commitments by President Biden to redouble efforts to combat climate change.

By Jim Tyson • Feb. 2, 2021 -

Study: Digital finance helped CFOs obtain pandemic aid

Government multiplied the impact of PPP and other aid thanks to the robust digital infrastructure in place, a McKinsey study found.

By Jim Tyson • Feb. 1, 2021 -

Companies that divested assets achieved high EBITDA growth: study

Especially for those facing earnings pressure, companies that divested during a downturn were able to boost cash flow, PwC says.

By Jim Tyson • Feb. 1, 2021 -

Deep Dive

5 CFO tips for tapping today's abundant capital

Record monetary and fiscal stimulus is flooding markets with liquidity, giving CFOs an unusual opportunity to improve capital structure.

By Jim Tyson • Jan. 29, 2021 -

Survey: US companies retrenched less during pandemic than firms in China, India

The coronavirus has compelled fewer staff and pay cuts among U.S. companies than among firms in China, India and the Middle East, according to a survey from the Institute of Management Accountants.

By Jim Tyson • Jan. 28, 2021 -

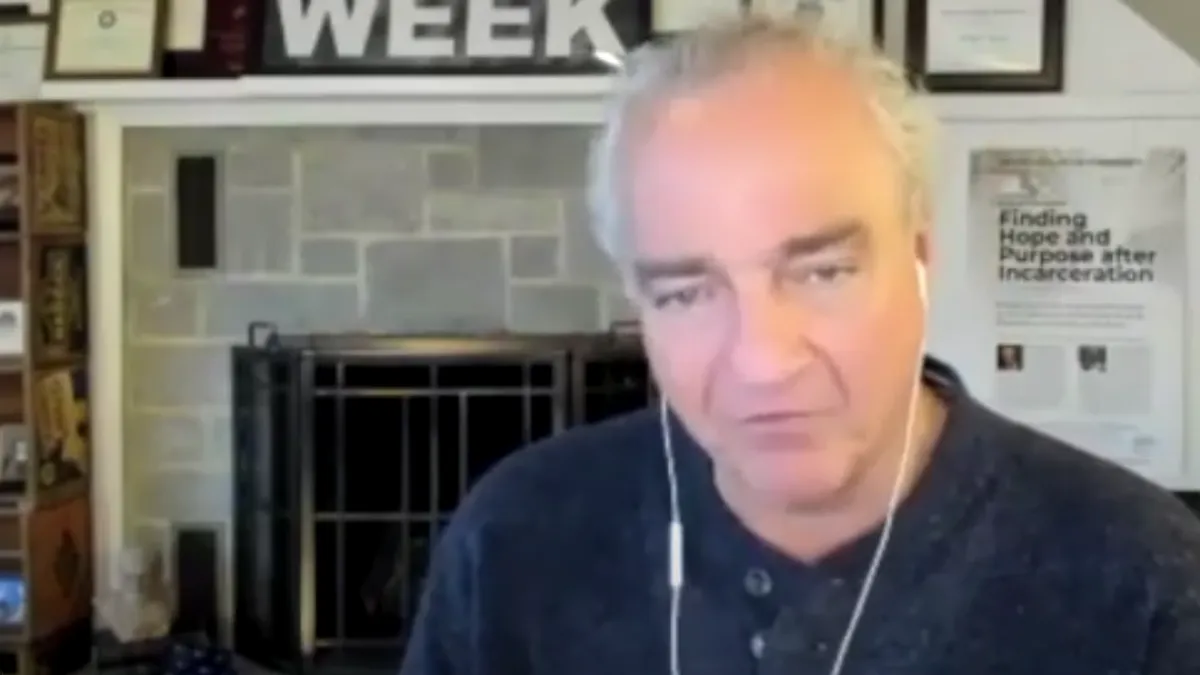

Screen grab/CFO Dive, data from White Collar Week

Screen grab/CFO Dive, data from White Collar Week

After serving time, fraudster cautions against PPP, other emergency loans

Taking money hastily can create more problems than it solves if the additional resources aren’t tethered to need.

By Robert Freedman • Jan. 27, 2021 -

Remote work, whistleblower laws poised to fuel PPP, other fraud prosecutions

As the second year of PPP loans winds down, expect a surge in allegations by employees who feel declining allegiance to their employers, attorneys say.

By Robert Freedman • Jan. 26, 2021 -

SBA approves over $5B in loans during first week of PPP re-opening

Amid mounting costs from the pandemic, the SBA begins a new round of Paycheck Protection Program lending approved by Congress in December.

By Jim Tyson • Jan. 25, 2021 -

EY report: IPOs surge worldwide during Q4 amid pandemic

Liquidity from pandemic-related government spending helped fuel a rise in global IPOs during the fourth quarter of 2020 that will likely persist in 2021, Ernst & Young said.

By Jim Tyson • Jan. 24, 2021 -

Yellen: Small business, COVID-19 aid more important than deficits right now

The Biden Administration wants to amend rather than repeal the 2017 tax law by eliminating some benefits to large companies and the highest-income taxpayers, the Treasury nominee said during her confirmation hearing.

By Jim Tyson • Jan. 20, 2021 -

Deep Dive

4 ways CFOs can cut waste in spending on the cloud

The typical company wastes as much as 35% of its cloud budget, estimates show. Wasteful spending rose as many companies rushed to move operations into the cloud during the pandemic.

By Jim Tyson • Jan. 18, 2021 -

CFOs, HR leaders optimistic about recovery in 2021, survey finds

Financial executives at emerging and mid-market businesses expect COVID-19 vaccine distributions this year to brighten the economic outlook.

By Jim Tyson • Jan. 14, 2021 -

Retrieved from Unsplash.

Retrieved from Unsplash.

Companies experiencing financial, operational stress from COVID-19, survey finds

Publicly traded company leaders anticipate a surge of bankruptcies as the dust clears, a Boston Consulting Group survey found.

By Robert Freedman • Jan. 12, 2021 -

Deep Dive

2021 Outlook: Why, and how, the CFO should lead ESG efforts

This year, CFOs should prepare their companies for increased scrutiny on environmental, social and governance performance, if they haven't already.

By Jane Thier • Jan. 12, 2021 -

North American M&A deal volume hits record Q4, survey finds

Although deal-makers shook off the pandemic during the fourth quarter, total global transactions fell last year to the lowest level since the mortgage finance crisis.

By Jim Tyson • Jan. 12, 2021 -

As fraud rises, CFOs must approach numbers skeptically, report finds

Executives might be committed to accuracy, but middle managers and others throughout the organization must be on board, too.

By Robert Freedman • Jan. 12, 2021 -

Deep Dive

5 CFO trends to watch in 2021

Greater attention to ESG metrics, real-time data and the wind-down of LIBOR are among the trends you'll see this year.

By Jim Tyson • Jan. 11, 2021 -

Careful pruning, not blanket cuts, aids post-pandemic growth

Start with below-the-line costs, be strategic on headcount and cloud spend, and look for ways to get customers to newer products, finance executives say.

By Ted Knutson • Dec. 22, 2020 -

Opinion

CFOs must consider tax, legal issues before closing offices

Work with your HR chief to factor in your organization’s talent strategy before deciding how much real estate you want to let go; having permanent remote workers has far-reaching implications.

By Steve Black • Dec. 20, 2020 -

SEC's cooperation credit an olive branch that can come with thorns

Clarity would help companies weigh the cost of cooperation against the benefit they might, or might not, receive in return, enforcement specialists say.

By Ted Knutson • Dec. 15, 2020 -

Feds OK 18-month LIBOR reprieve

Existing instruments are expected to be main beneficiaries; new issues still on track to use different rates.

By Robert Freedman • Dec. 14, 2020