Financial Reporting: Page 41

-

Audit committee job creep taking its toll

With internal audit committees biting off more than they can often chew, committee members across businesses are feeling the burnout.

By Elizabeth Flood • Feb. 3, 2023 -

Activision Blizzard to pay SEC $35M for alleged disclosure flaws

The video gaming company has been the target of regulatory scrutiny since allegations of sex discrimination surfaced in 2018.

By Jim Tyson • Feb. 3, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineCFO best practices in the evolving generative AI era

As the initial frenzy around the launch of generative artificial intelligence subsides, a new GenAI era appears to be taking shape.

By CFO Dive staff -

Interim Illumina CFO takes permanent seat

Joydeep Goswami’s appointment marks the executive’s first role in finance, and happens as the company faces headwinds from an acquisition last year.

By Elizabeth Flood • Feb. 1, 2023 -

FASB poised for another crypto vote

The FASB is on track to issue proposed new standards for cryptocurrency by April. The implosion of crypto exchange FTX is likely to sharpen scrutiny of the project.

By Maura Webber Sadovi • Jan. 27, 2023 -

Southwest ups tech spend to $1.3 billion

The airline will be increasing its technology spending following a quarterly loss triggered by its holiday traveling system failure, which resulted in the cancelation of over 16,700 flights in a ten-day period.

By Grace Noto • Jan. 27, 2023 -

CFO FP&A Close-up: finance function’s ‘octopus’

Between intergenerational differences and specific skillsets, CFOs need to get a handle on how FP&A execs operate.

By Elizabeth Flood • Jan. 27, 2023 -

Auditors dialed back mandated disclosures: study

The study found that auditors pulled back on their disclosures of potentially negative financial matters as companies adjusted to new reporting requirements.

By Maura Webber Sadovi • Jan. 26, 2023 -

IBM, SAP latest to slash workforce

IBM joins Microsoft, Google, Salesforce and now SAP SE in paring down its workforce as the technology and software industries face a highly inflationary environment.

By Grace Noto • Jan. 26, 2023 -

How to balance growth and cash flow amid uncertain demand

Meritech Capital partner joins Airbase CFO to discuss metrics as a framework for when to say ‘no’.

By Elizabeth Flood • Jan. 26, 2023 -

Motorcycle retailer RumbleOn taps new CFO

The Irving, Tex.-based company is swapping in a new CFO just under a year after the outgoing finance chief took the finance reins.

By Alexei Alexis • Jan. 23, 2023 -

Huntington preps for mild recession following earnings beat

The regional bank will aim for low-level expense growth and conduct some measure of organizational restructuring as it looks to position itself to weather a mild recession, CFO Zach Wesserman said.

By Grace Noto • Jan. 20, 2023 -

SMEs fall behind on addressing climate change

A readiness gap is emerging between small and large companies in terms of their responses to climate change risks.

By Elizabeth Flood • Jan. 20, 2023 -

nCino cuts 7% of workforce, CFO departs

nCino and Microsoft are the latest tech firms to announce layoffs. The sector has been hit by declining sales for PCs and software, plummeting valuations and high inflation.

By Grace Noto • Jan. 19, 2023 -

Opinion

3 reasons to make accounts receivable a top priority

Unpaid invoices take a nasty bite out of cash flow. Dean Kaplan writes that taking time early on to evaluate receivables and stratify accounts for fast attention will pay off.

By Dean Kaplan • Jan. 18, 2023 -

SEC aims to set climate risk, cybersecurity rules before May

The agency, laying out an ambitious agenda, aims in early 2023 to complete several new regulations, many of them focused on increasing disclosures for investors.

By Jim Tyson • Jan. 17, 2023 -

Wendy’s US CFO resigns amid shake-up

The Dublin, Ohio-based hamburger chain is losing its U.S. CFO to another restaurant company as Wendy’s redesigns its organizational structure to pursue a long-term growth strategy.

By Elizabeth Flood • Jan. 17, 2023 -

‘Scope creep’ challenging audit committees: CAQ

Audit committees are taking on more responsibilities as the SEC writes several rules requiring more detailed corporate disclosure.

By Jim Tyson • Jan. 13, 2023 -

Ex-CFO of email security firm pleads guilty in $50M fraud scheme

The former CFO of GigaTrust faces a maximum sentence of five years in prison for his role in a conspiracy to defraud investors and lenders, including by fabricating bank statements.

By Alexei Alexis • Jan. 13, 2023 -

Pension funding holds flat, higher costs loom

Pension and retirement plans can be a key benefit that helps employers attract and retain workers. They may carry higher costs for companies in 2023.

By Dawn Wotapka • Jan. 12, 2023 -

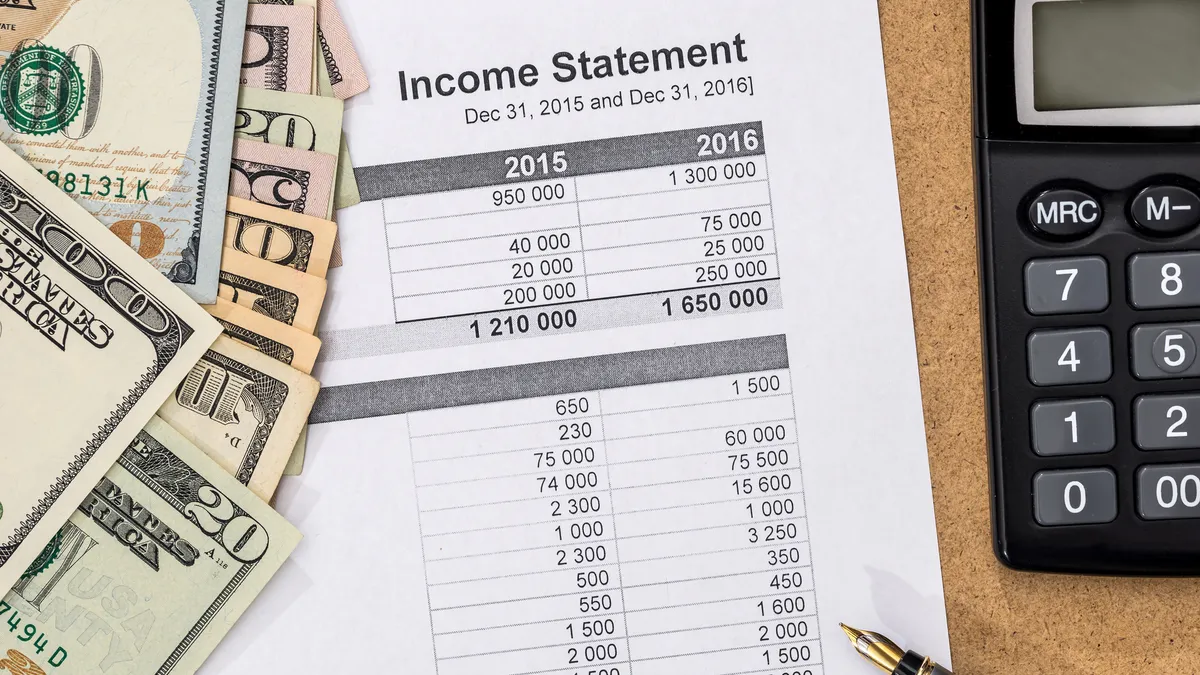

FASB decides to require expense disclosures

For investors, the new income statement disclosure project is the FASB’s most important initiative “by a factor of ten,” one board member said. But it will mean added costs for companies.

By Maura Webber Sadovi • Jan. 11, 2023 -

Alcoa taps controller for CFO

Alcoa’s controller will move to its CFO seat among an executive restructuring plan designed to help the company focus more deeply on cost and innovation.

By Grace Noto • Jan. 11, 2023 -

EY consulting arm poaches Cargill CFO

Ernst & Young is moving forward with a “soft separation” of its audit and consulting arms, appointing Jamie Miller to the CFO seat of what will be a new public entity.

By Elizabeth Flood • Jan. 11, 2023 -

Bed Bath & Beyond doubles down on cuts, layoffs

The absence of the retailer’s interim CFO from Tuesday’s earnings call could signal that a bankruptcy filing or sale is imminent.

By Maura Webber Sadovi • Jan. 10, 2023 -

Trump ex-CFO sentenced to five months for tax fraud

The sentencing comes about one month after a jury convicted two Trump Organization affiliates of tax fraud and other crimes. The company’s former CFO testified for the prosecution during the trial.

By Grace Noto • Jan. 10, 2023 -

FASB continues push for corporate expense disclosures

As the FASB kicks off its first meeting of the new year Wednesday, the U.S. standard setter faces external pressure to step up the pace of its process.

By Maura Webber Sadovi • Jan. 9, 2023